Next Thursday!

May you talk with the nonbankrupt coborrower of a bankrupt borrower? If so, what may and what shouldn’t you say? Does the type of bankruptcy (Chapter 7 or Chapter 13) matter? Does the purpose of the debt matter? Does it matter whether you called the coborrower or the coborrower called you?

May you repossess collateral owned by the coborrower alone?

May you file suit against a nonbankrupt coborrower while the bankruptcy is pending? If you obtain judgment, may you enforce it against the nonbankrupt coborrower? May you enforce a judgment you obtained before bankruptcy against a coborrower during a bankruptcy?

Most collectors know they may not attempt to collect a debt from a borrower who is in a pending bankruptcy; but what about coborrowers or others who are not in bankruptcy? The rules are different for Chapter 7 and Chapter 13 cases, but how much different are they?

Chapter 7 and Chapter 13 collectors should consider all sorts of questions before communicating with a coborrower who is not bankrupt: May you answer the coborrower’s questions about the borrower’s bankruptcy case? May you initiate communications to tell the coborrower about the bankruptcy as long as you don’t ask for payment? Does the coborrower have a right to be kept informed about the debt and the bankruptcy? May you repossess collateral owned by a nonbankrupt coborrower? If you already have judgment, may you levy on assets or wages of a nonbankrupt coborrower? Does the purpose of the debt matter?

During this program, participants will learn the answers to those questions, as well as:

- How the rules relating to Chapter 7 bankruptcies differ from Chapter 13.

- What you may (and may not) say to a coborrower of a Chapter 7 debtor.

- What you may (and may not) say to a coborrower of a Chapter 13 debtor.

- What you may tell a coborrower about a debtor’s bankruptcy.

- When you are entitled as a matter of law to a court order permitting you to collect from a coborrower.

- Why a debtor’s attorney will sometimes agree to a court order permitting you to collect from a coborrower; you just have to ask.

- Whether you may repossess collateral owned by a coborrower or spouse.

- Whether you may enforce a prepetition judgment against a coborrower or spouse.

- Whether you may sue a coborrower, and why that might not be a good idea even when it is allowed.

- What rights you have against a coborrower after the bankruptcy is over

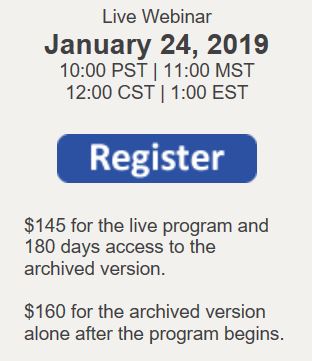

For more information, call NorthLegal at 623.537.7150. To register, visit http://northlegal.com/nl-webinars/2019/19-0124-BK103-Coborrowers.php

UPCOMING NORTHLEGAL CONFERENCES

June 10, 2019

New Orleans, Louisiana

June 11-14, 2019

New Orleans, Louisiana

August 12-15, 2019

San Diego, California

NorthLegal Training and Publications | 5115 N. Dysart Rd, No. 202-500, Litchfield Park, AZ 85340

Facebook Comments