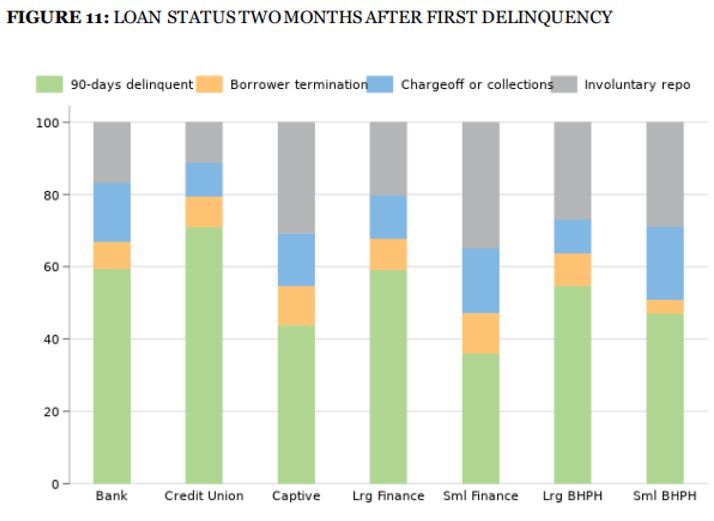

Almost unnoticed last month, the Consumer Financial Protection Bureau released a Data Point report on Subprime Auto Loan Outcomes by Lender Type. In this forty-six-page report, they examine the effects of interest rates and default risks variances based upon different types of subprime lenders and how variations in interest rates can be explain the differences in default rates.

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Chinese National Caught in International Auto Loan Fraud Ring