There are the personal “straw buyer” loans, where a relative or friend signs a loan for a friend of low credit quality. And then, there are dealer perpetrated “straw buyer” loans where the dealer recruits third parties to sign for loans that they have no intention of paying for who are intended for strangers or theft. While most of us would think that the latter of these is a relatively new scam, it’s actually been going on for at least 80 years as the story I am about to share with you illustrates.

Choice Motor Sales

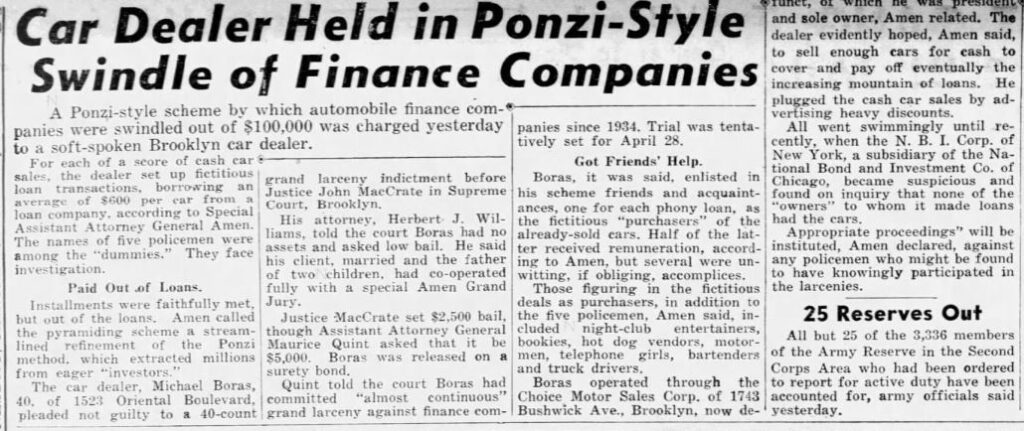

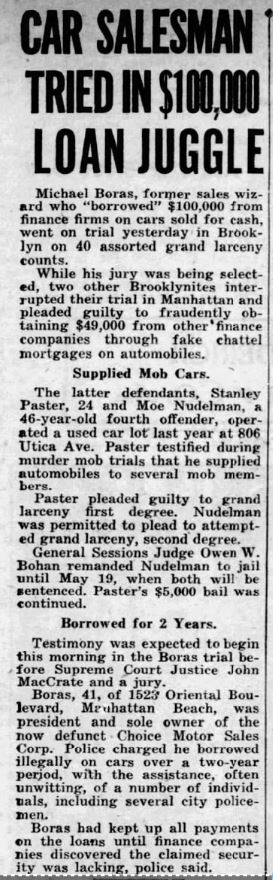

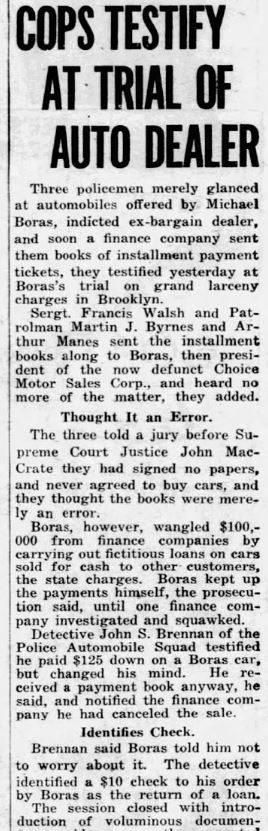

The fraud enterprise, was run by an independent dealer, named Michael Boras of Brooklyn, NY based Choice Motor Sales of 1743 Bushwick Ave., Brooklyn, NY, who recruited a vast array of straw buyers, ranging from street vendors, bartenders, truck drivers and even five NY cops!

For a mere $10-$15, these “straw buyers” would sign on the dotted line for loans on autos, which Boras would convince them would be paid off shortly, while he received his customary $600 dealer commission from the finance companies.

Boras would later sell the vehicles for cash, which he would then use to make payments on the loans and perpetuate the scheme. Basically, a traditional “Ponzi Scheme.”

Keep in mind, this was before WWII.

But like all Ponzi Schemes, it finally came crashing down.

When the House of Cards Crumbled

Forty loans and two years later, the three defrauded finance companies began to notice the common threads, when the loans defaulted and they eventually discovered that the vehicles were not in possession of the alleged borrowers. $100K ($1.9M in 2023 value) in losses later, the District Attorney was brought in and uncovered Bora’s “straw buyer” scheme.

In April of 1941, Boras was arrested and put on trial for 40 counts of larceny. Boras pleaded not guilty of the charges and made bail of $2,500. But when the trial began, the story thickened.

Five New York police officers testified to the court that they never payment for participation in the scam and never signed any papers. When two of them received payment books, they returned them to Boras at Choice Motors and never heard anything more about the matter.

Boras claimed that he was aided in the scheme by Charles Erenberg, assistant credit manager of the N.B.I. Corp. A claim that Erenberg strongly denied.

After an 8-day trial and 10 hours of deliberation, the Supreme Court jury reached their verdict. Amazingly, Boras was found innocent of all charges. Perhaps the multiple levels of complicity between the lender and the police made the jury question why they weren’t on trial as well and preferred not to persecute one without them all being included, who knows?

The NYPD were obviously not easily convinced of the participating officer’s innocence. They were allegedly reprimanded internally for their participation.

And it Still Goes On

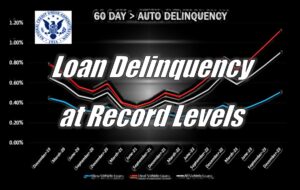

So here we are almost a century later and these scams still work. With rising interest rates and tightening underwriting, we can expect a lot of the more benign “bread and butter” variety of these to occur.

But as dealers struggle to keep up sales volumes and profits, it’s very likely that we will see a resurgence in these dealer perpetrated schemes. As hard to believe that anyone would fall for being a signer for these scams, they will.

The Dealer at 1743 Bushwick

Not surprisingly, Choice Motor Sales went out of business. But after all these years, there was still a car dealership at this location until the pandemic. With obvious new owners, unrelated to the aforementioned Boras, FM Auto Sales operated from the very same lot but has since converted to an auto body and tire shop.

Repo Blood

This story is just one of many stories of crime, fraud and repossession included in my book Repo Blood – A Century of Auto Repossession History. Buy a copy today!

Dealer Fraud – The Earliest Account – 1941 – Fraud – Repo Blood – Repossession History – Credit Union Collections – Credit Union Collectors

Facebook Comments