“of all loans, 1.84% were severely delinquent, which was an increase from 1.74% in November and the highest rate since February 2009.” – Cox Automotive

2022 closed out with some telling data points. Auto loan delinquency was up and sales were down. Inflation eased slightly as did the CPI, but the economy is not out of the woods by any means. Lurking beneath these high-profile statistics are some very troubling trends.

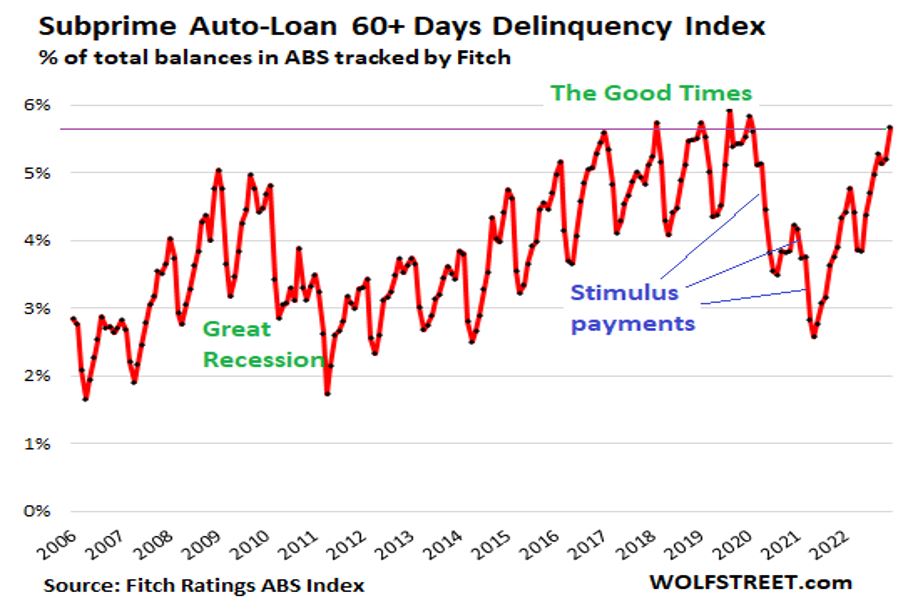

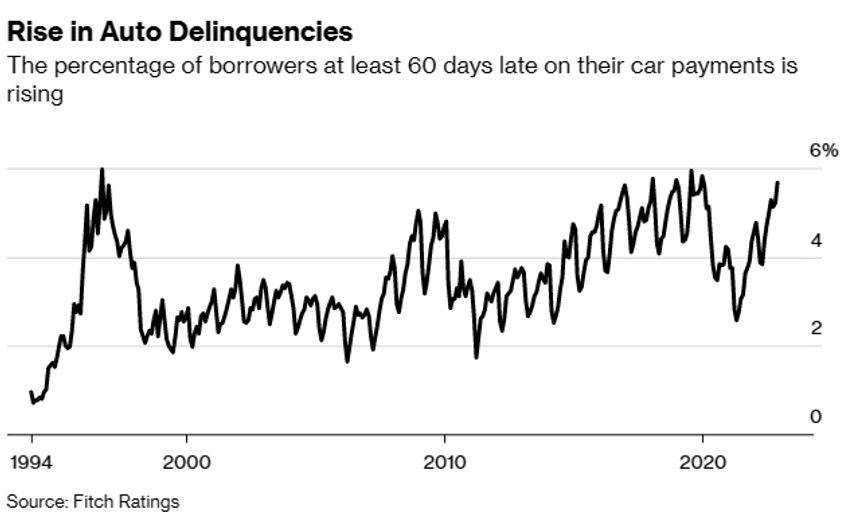

It is no secret that December delinquency is by tradition, the highest of the year. So, the fact that we saw sixty-day delinquency rates on subprime auto loans spike should come with little surprise unless you look back to what they resemble.

According to Cox Automotive, In December, 7.11% of subprime loans were severely delinquent, increasing from 6.75% the prior month. The subprime severe delinquency rate was 163 basis points higher than the prior year, and the December rate was the highest in the data series back to 2006. This is the highest delinquency for this credit tranche since January of 2009 during the peak of the Great Recession.

While this is subprime, which accounts for about 14% of all auto loans, it is not an isolated incident. Cox Automotive also reported that of all loans, 1.84% were severely delinquent, which was an increase from 1.74% in November and the highest rate since February 2009.

Severe Delinquent vs. Default

And while repossession activity is increasing, there appears to be some greater resistance by lenders to repossess. Some of this can be seen by what the definition of what a default is versus what is deemed as severely delinquent.

The supporting data defines default as being 90 to 120 days late or later. This is literally on the edge of charge off and being down 4 to 5 payments or more and has little to no chance for redemption or reinstatement. That said, there are those in default, the majority of which are soon to join the default category. This suggests that a coming surge of repossession activity could be hitting over the next few quarters.

Tapped Out

As of the pandemic hadn’t done enough damage, over the past twenty months, we’ve seen record inflation and fuel price spikes. These have been weighing heavy on the average American consumer whose personal savings have been dwindling and have been tapping into their credit card balances to stay afloat.

And throughout this same twenty-month period, consumers have been actively buying cars and trucks. Cars and trucks with inflated values. Inventory shortages created a feeding frenzy on the lots and dealers raked in on this trend. Dealers began gobbling up inventory from anywhere they could, knowing that they could make a profit on even older cars in this market.

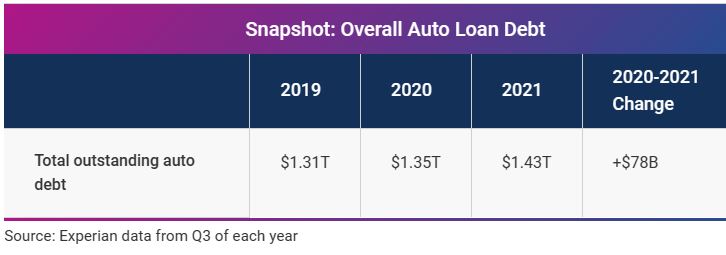

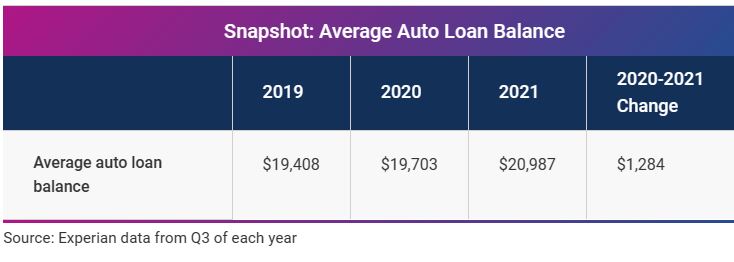

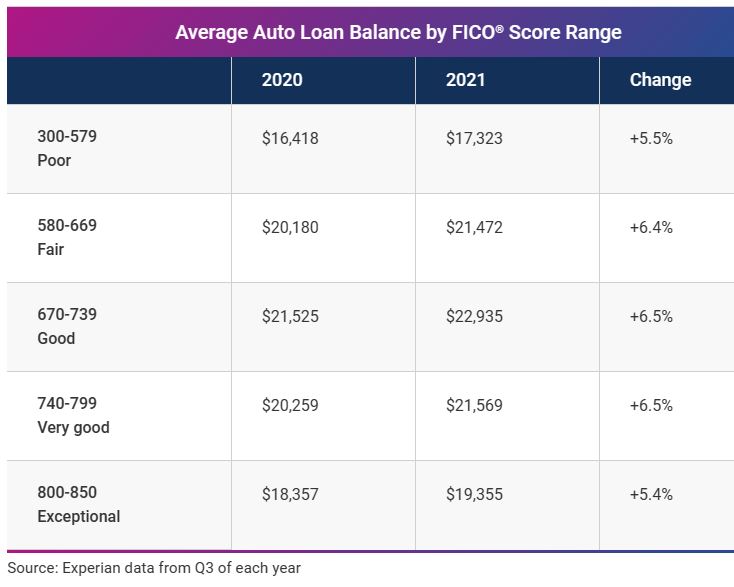

Experian reports that during 2021, consumers owed a total of $1.43 trillion on the vehicles they drive in the third quarter of 2021, an increase of $78 billion over the previous 12 months. The average auto loan balance exceeded $20,000 for the first time ever. The average price of vehicles increased more than any other major category in the consumer price index, except for energy.

They also reported that over the past decade, the average auto loan amount has steadily increased, reaching $41,665 for a new vehicle and $28,506 for used vehicles in the third quarter of 2022. One concerning area is that for new car buyers with nonprime to fair credit tiers (601 to 660), they take out the largest loans; $44,530, on average. In the higher Prime credit tiers, they take out the most for used cars at an average of $30,222. This is considerably higher than the previous years $29,065.

According to their third-quarter 2022 data, the average car payment for a new vehicle is $700 a month, up 13.3% year over year. According to Edmunds, More than 15% of consumers who financed a new vehicle in Q4 2022 committed to a monthly payment of $1,000 or more, this is the highest percentage ever and is up from 0.5% in Q4 2021 and 6.7% in Q4 2020.

These escalated balances and payments began in 2021 and only got worse in 2022. These are adding significant strain to the financial stress already created by inflation. But with the average peak levels of default in a pool of auto loans hitting at about 18 months, it is about to get worse.

Sales and Values

Dealertrack indicate that used retail sales declined 7% in December from November and were down 10% year-over-year. According to the Manheim Index, wholesale vehicle values increased 0.8% in December on a seasonally adjusted basis. The decline left the re-based Index at 219.3, down 14.9% from a year ago. This was the largest year-to-year decline in the series’ history.

The Fed’s campaign against inflation is being felt all across the lending spectrum and with rising interest rates comes yet higher payments. It is weighing down on the critical flow of wholesale units rolling back into the retail market and driving down wholesale values. Wholesale values that help determine the trade-in value on future transactions.

This plays itself out in many ways as consumers need a new car or simply desire to buy into something more economical with lower payments. When a car’s balance exceeds its trade in value, it is deemed to be “underwater” and thus creates a negative equity value when applied to a new purchase.

The only way out of this is cash down to offset this balance and this is an option that many borrowers simply cannot afford. Facing this dilemma, many borrowers will simply apply some cash down and accept the new deal without the trade in and kick the old car to the curb for voluntary repossession.

It is Coming

It is impossible to say how many loans that are reported at month end December to be in “severe delinquency” have been given up on by the consumer as illustrated above and will roll into default and turn into a repossession. But as wholesale values remain flat and interest rates remain high; this scenario increases in frequency.

Seasonal fourth quarter rises in delinquency are an accepted norm which we’ve come to accept. It has also been well accepted that traditionally it subsides over the next quarter. But these expectations may not manifest themselves as they have in the past. Time will tell.

As the Fed increases interest rates to cool inflation, the cost of everything purchased on credit increases. These costs are transferred on to the living expenses of the lower income brackets and middle classes most. It is not only the Fed’s expectation, but their desire, to increase the unemployment level. And it’s already starting as well illustrated in the technology sector which has opened up 2023 with over 200K layoffs.

This is bound to get far worse before it gets any better.

Regardless, we are now witnessing delinquency at pre-pandemic levels with data resembling the Great Recession and there are no signs of letting up. If second quarter trends show little or no signs of significant improvement, expect a rough summer of delinquency. And as these repossessions hit the auction block, don’t be surprised to see some large loan deficiencies that drive up the charge off ratios for all lenders.

Kevin Armstrong

Publisher

December 22’ Auto Loan Delinquency Data – Worst Since 2009 – Delinquency – Experian

Facebook Comments