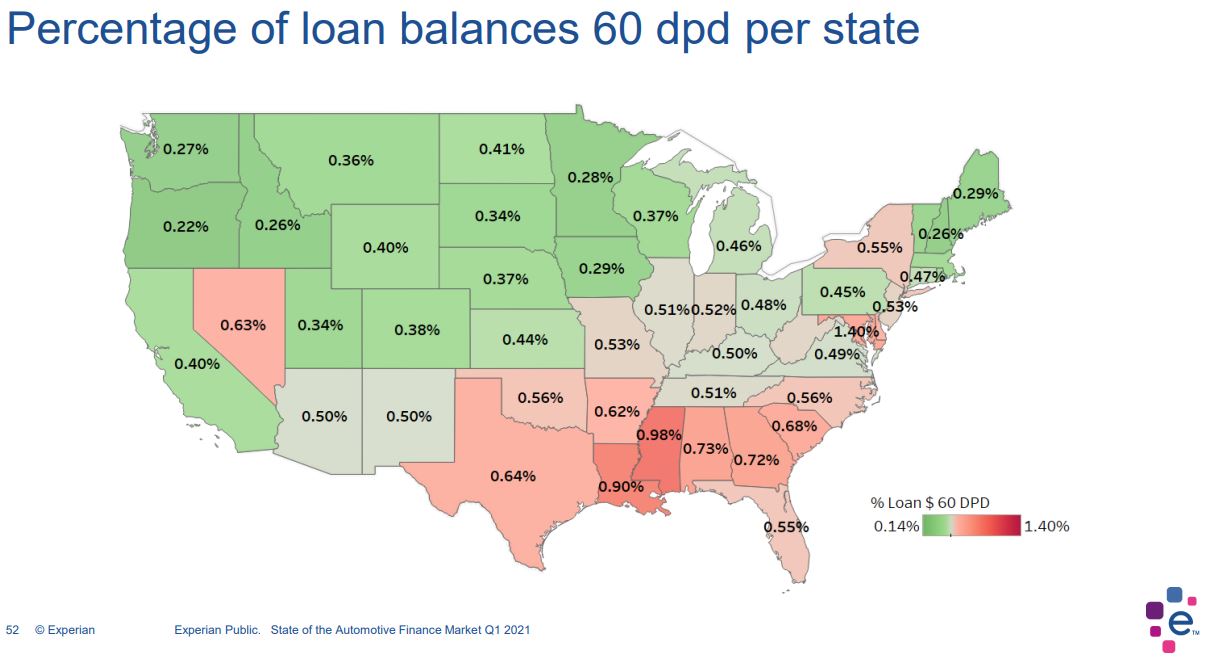

Experian, the world largest credit reporting bureau, released it’s Q1 2021 State of the Automotive Finance Market Report yesterday and released some data that does not bode well for the future of repossession volume in the second quarter of 2021, at very least.

Experian Q1 Auto Finance Trends Show Bad News for the Repo Industry

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Chinese National Caught in International Auto Loan Fraud Ring