Experian, the world largest credit reporting bureau, released it’s Q1 2021 State of the Automotive Finance Market Report yesterday and released some data that does not bode well for the future of repossession volume in the second quarter of 2021, at very least.

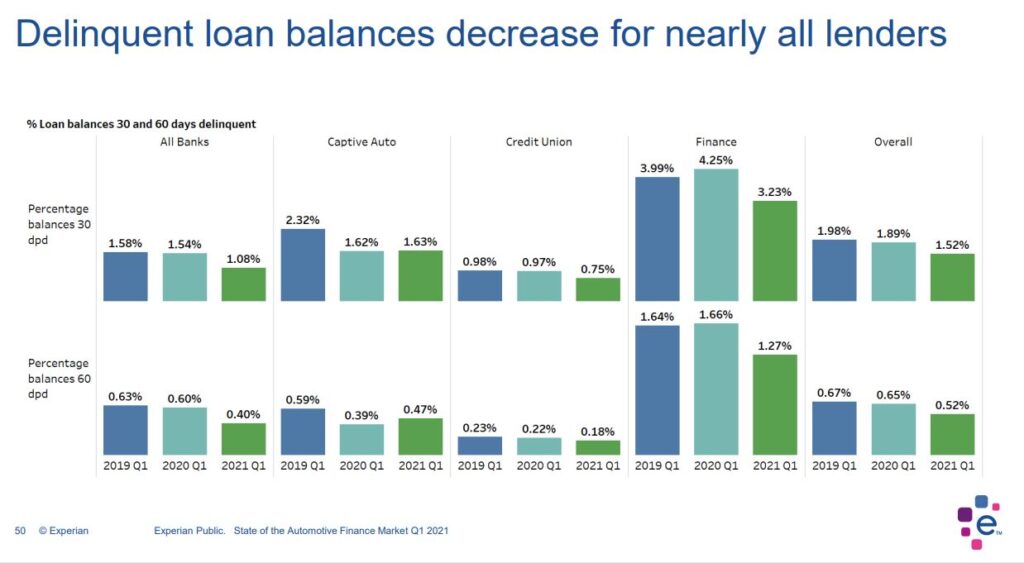

According to their data, year over year auto loan and lease delinquency ratios have decreased 0.38% across the board when compared to the same time in 2020 and -0.43% when compared to 2019.

Looking at the same data by loan balance, the results were very similar with a 0.37% decrease from 2020 and a -0.46% when compared to 2019.

When drilling their data down by state, the results are consistent with years past where the south and southeastern states showed the highest 30-day delinquent loan delinquency ratios. Mississippi has the nation’s highest at 2.82% while Oregon came in with the lowest in the nation at 0.82%.

30-day delinquency (down two-payments) is an important tranche in that it can serve as a predictor of impending 60-day delinquency as a certain percentage, anywhere from 10%-20% of this depending on lender, tends to roll into 60-days delinquent.

Taking it up a step to look at the prime repossession tranche of 60 days past due, the results were similar, with the exception that Nevada showed a wider gap between 30-60 days than many states. Again, this is a tranche (down three-payments) where repossession assignments tend to evolve.

The provided data does little to encourage any level of optimism that auto repossession volume will increase anytime in the near future. Obviously, is 2020 taught us anything, it is that the only thing we can expect it the unexpected. Instability that could trigger volatility to the economy is still present. With unemployment numbers remaining stubbornly high and inflation rearing its ugly head, there is always the possibility of increases in delinquency and subsequent recoveries.

See the entire presentation here!

Facebook Comments