EDITORIAL

Why is the repossession industry dying? Simple. You’re getting hosed!

There has been a lot said about the recently announced ARA compliance mandate agreement with Bridgecrest/Drivetime. Mostly about the value of not only this agreement, but the sudden change of stance in regards to low paying contingency assignments. While I’ll avoid confronting those issues for now, Bridgecrest is a perfect example of a lender who has been picking away at the industry for years and I have some data to show it in action.

A reader who has a history with Bridgecrest recently supplied me with a chronological history of his agencies fee history with Bridgecrest over the last ten years that illustrated this point perfectly.

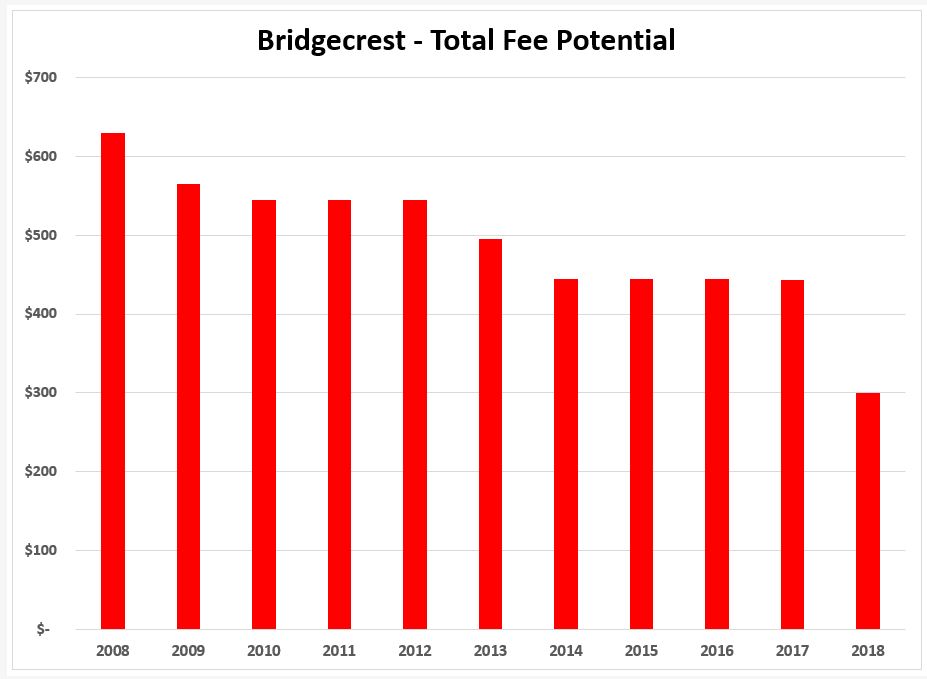

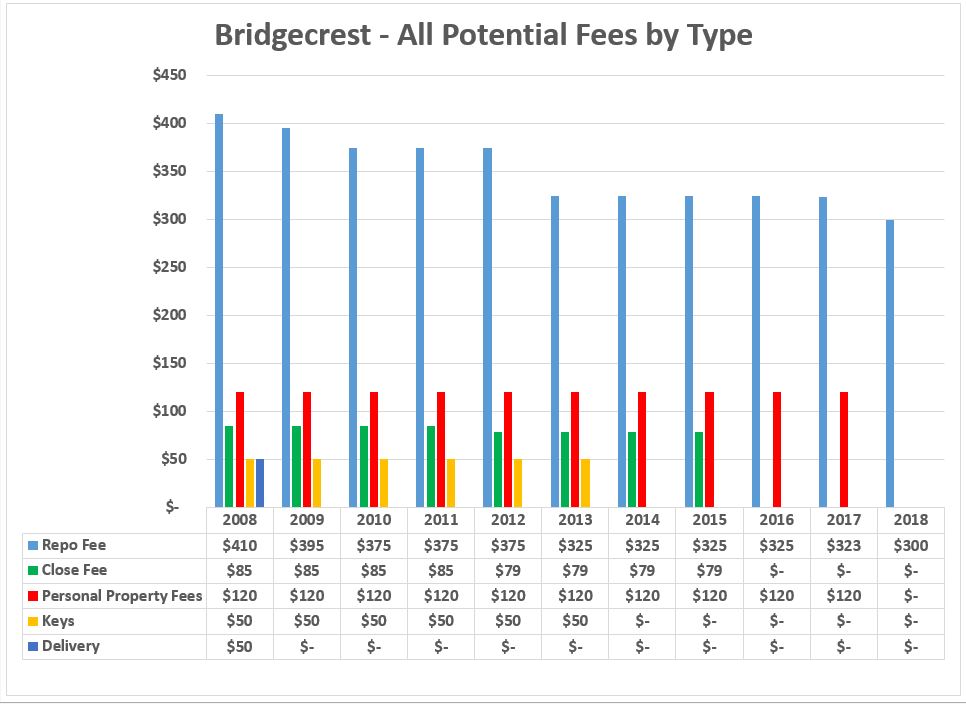

Starting in 2008, Bridgecrest paid well. As shown in the chart below, they paid all fees and allowed the collection of required state sales taxes making the average maximum potential fees earned per repossession up to $630 per repossession, with the inclusion of keys, delivery and personal property fees. Obviously, not every repossession incurs every one of these fees, but this is offset by the loss of closing fees and the agencies required absorption of taxes.

As illustrated, and using some base average numbers, we can see that through the slow picking away of fees over time, many of them small, the potential earnings on a repossession decreased 52% over a ten year period. Keep in mind, this does not include the changes demanded by the lender for the agency absorption of required state sales taxes on reinstatements and other ancillary fees of nearly 8%. So, I am actually being very liberal toward Bridgecrest. All in, the total income derived from working for Bridgecrest decreased by as much as 60% over ten years!

Using these numbers, in order to make the same income from ten years earlier, you would need to recover more than twice as many units just to make the same gross income as you did ten years ago and that isn’t even taking into account the extra expenses on fuel and commissions.

Everyone knows that the cost of operations has increased dramatically over the past ten years. Making the same income now as ten years earlier clearly puts you in a deficit in this lender relationship. Making less puts you in the position to fail.

Unfortunately, this is just one example of the many lenders and forwarders who’ve watched agencies bow to their demands little by little through the years. I could do the same comparisons with Santander and others and come up with similar results. Each and every little demanded fee concession the agency takes, the more they have to try to make it up in volume while fighting against the wave of inflationary expenses.

These are the straws breaking the proverbial camel’s back and killing off the repossession industry.

Now, the ARA has joined in by partnering with a lender who is slowly strangling the repossession industry with a mandate that requires agencies to only use their compliance program even if they have already spent the time and money on other professional and competent programs. “But it’s free” and “This is different, we’re an association” they say.

Free compliance isn’t free. It comes with a cost. It costs time. Is yours free? I imagine not. Being an association, they should know better.

Didn’t the ARA just agree with every other association that low paying contingency assignments were dangerous and detrimental to the industry just six months earlier when RISC partnered with Santander making an almost identical offer?

Is this the unity that will help pull the industry together and create sustainable conditions requisite for the overall betterment of all agencies? To me, it’s seems not, and that they have merely given in to the lender created fee suppression that is killing their own industry in the effort to attract new members. New members whose businesses will eventual wither and die under these conditions.

How is this a “Win” for the industry?

Kevin Armstrong

Editor

CUCollector.com

Facebook Comments