Available industry data is clear, if a repossession agent has not recovered a vehicle within 30 days of working it properly, the recovery rate after that point is typically in the 6%-9% range. This reality provides a strong incentive to rotate the assignment to a different provider in order to improve the likelihood that a charge off can be avoided. With that said, ‘skip to repo’ services can be an alternative to leaving the assignment with an agent for the final 20 days before charge off.

Historically, the obstacle to utilizing such a service prior to charge off has been cost. To materially improve recovery rates prior to charge off, a skilled skip tracer equipped with a wide range of tools is required. Accordingly, most reputable firms charge $650+ for a pre-charge off skip recovery which is significantly more than what an agent or forwarder will charge for simply leaving it as a first placement case. As detailed in the remainder of this article, while more expensive, the ROI on the additional investment in the recovery is well worth it.

The higher costs aside, the implications of not recovering the car prior to charge off are significant. In addition to having to charge off the loan, which everyone wants to avoid, resale valuations are falling every day due to depreciation. Also, in most cases, the fees charged for a post charge off skip are meaningfully higher than a pre-charge off skip case.

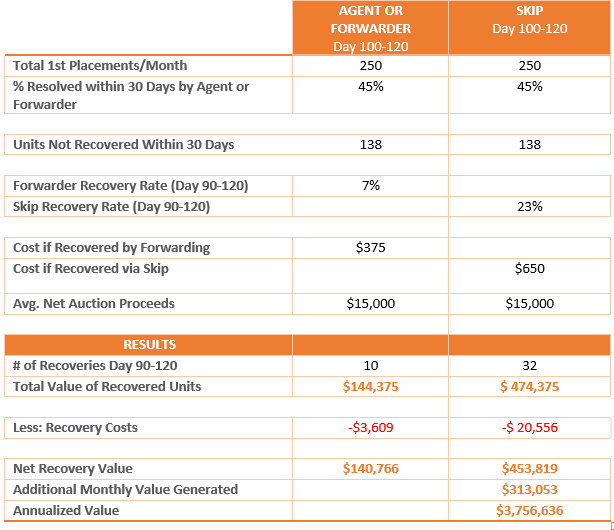

Return on Investment Analysis

The chart below compares two different repossession strategies. The first analyzes the value of a lender who leaves the assignment with the same forwarder. The second analyzes the value of a lender who rotates the assignment to a different service provider for skip tracing. As you can see, rotating the assignment to another service provider has a much higher recovery rate and doesn’t need to generate much to offset the cost on all recoveries. Although the cost of pre-charge off skip is much higher, it delivers an ROI that makes it worth it.

While total repossession costs are higher, as clearly illustrated, the result of having pre-charge off skip outweighs the cost of service. It’s also important to note that while simply rotating the assignment to another forwarder or repossession agent will improve the chances for success, engaging a highly skilled skip tracing firm will yield significantly better results.

We work with several lenders that have deployed this strategy including SunTrust Bank, Wells Fargo, Regions Bank, US Bank, Exeter Finance and many more. If you would like to learn more about how your organization can benefit from this strategy, please contact Chris Vogelsong at 704-777-9923 or chris.vogelsong@alsresolvion.com.

About ALS | RESOLVION

Industry Experts in Minimizing Loss and Maximizing Recovery

In August 2014, American Lending Solutions and Resolvion combined to form ALS l Resolvion. In doing so, two of the nation’s leading skip tracing and repossession management firms came together to form an industry leader capable of handling virtually any recovery assignment for virtually any type of equipment.

We offer a powerful combination of unique technology, efficient processes and skilled people, all working together to minimize loss and maximize recovery for our lender clients. Whenever and wherever needed, whether it’s across town or across the country, our highly skilled team is available to resolve even the most challenging of cases.

Based on the unique needs of each client, we design industry-leading, fully scalable and customized solutions. Our valued client partnerships cover the spectrum from super prime to title lenders and from small to large volume financial institutions. We uphold the most comprehensive compliance program in the industry, while maintaining the highest standard of professionalism. Our total commitment leads to our client’s total confidence.

Facebook Comments