GUEST EDITORIAL

Are you looking to stop more fraud in your company? If you are, than you might not need to look any further than your credit losses to find the real opportunity. Based on industry studies there are mountains of fraud losses sitting in credit loss buckets at financial companies. It’s not million of dollars. It’s billions of dollars in hidden fraud just waiting to be discovered.

Most Fraud is Not Detected It is Hidden

Fraud is hidden. As I have always said, it is oftentimes a ghost. And if you don’t believe in it, it will come back to scare you. I believe banks and lending companies globally have billions of dollars of fraud that they don’t even know exist.

I am not making this up. I am basing it on industry data studies across multiple industries and multiple different research and analytic companies.

About 50% of Card Fraud is Sitting in Default

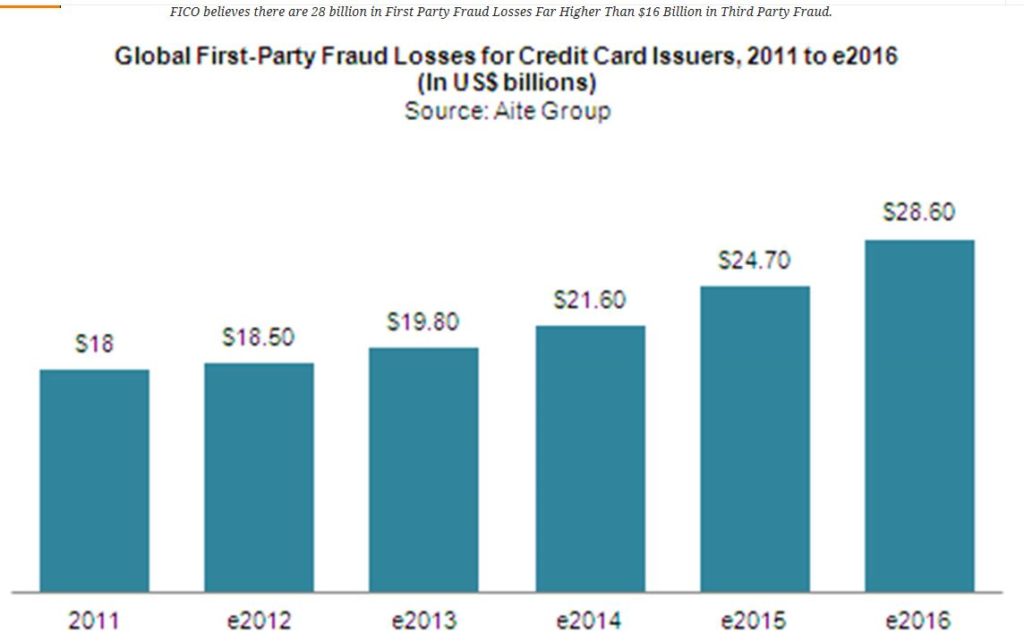

So why do I think most fraud is undetected? Well if you look at card fraud which is 16 billion annually, and then look at First Party Fraud on credit cards which runs at 28 billion annually, than hidden fraud is outpacing detected fraud almost 2:1

FICO believes there are 28 billion in First Party Fraud Losses Far Higher Than $16 Billion in Third Party Fraud.

BasePoint Analytics, Verafin, FICO, SAS, PointPredictive and many other companies have researched the problem of default and determined a very strong correlation to fraud.

70% or More of Auto Lending Fraud is Hidden in Defaults

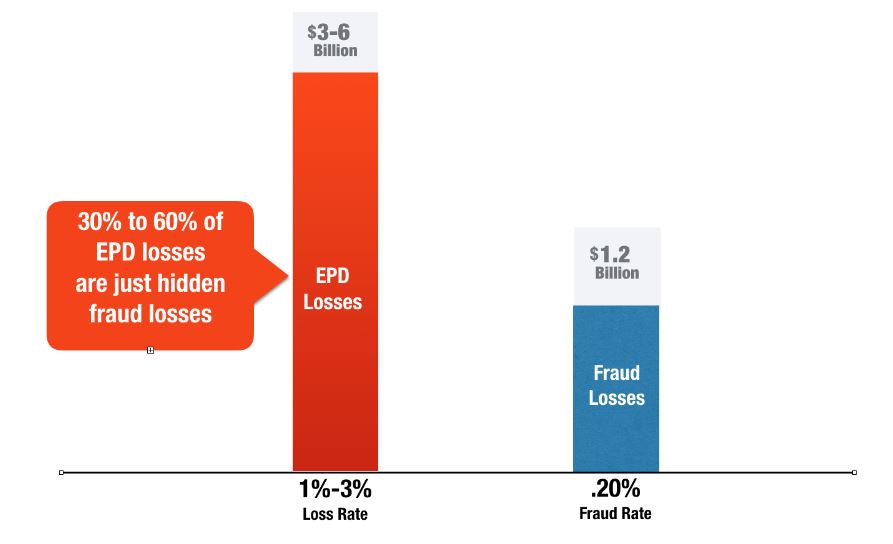

And PointPredictive analysis suggest that most auto lending fraud is probably hidden in early payment default losses. Current estimates of auto lending fraud in the US is 1.2 Billion per year. But when you compare that with hidden fraud that sits in early payment default buckets, it pales in comparison. Hidden auto fraud is between 3 to 6 billion which is 4 to 5 times the level of known fraud.

Almost Every Industry is Plagued By Hidden Fraud in Defaults

I conducted some research to determine how many industries are plagued by the same problem. There are many.

Here are some of the more notable statistical studies. As you can clearly see no industry is safe from misclassified fraud.

- 70% of Mortgage Early Defaults are Fraud – BasePoint Analytics (Now CoreLogic) based on study on millions of loans and many lenders. Their findings on the data suggested that up to 70% of the loans that defaulted within the first 6 months had evidence of material misrepresentation in the original application file.

- 20% of Credit Charge Offs Are Due to Synthetic Identity Fraud – Avivah Litan estimated that 20% of credit charge offs happened because individuals doctored their identity, creating synthetic id’s and applied for the card or loan.

- 40% of Auto Loans that Default in First 6 months Are Fraud – Based on data studies, PointPredictive Data Analysis suggested that 40% of the auto loans that default within the first 6 months had fraud on the initial application.

- 100% of Bank Accounts That Go Over Limit and Charge Off Are First Party Fraud – Companies like FICO have determined that banking and debit accounts that exceed their limit by more than 130% are very likely to be fraudulent intent.

- 10% to 20% of Bad Debt in the UK is Hidden Fraud – According to TSYS analysis the British Bankers Association found that 10% to 20% of Bad Debt losses on DDA accounts were misclassified fraud.

4 Ways to Find Hidden Fraud in Bad Debt

There are analytic techniques that can be used to find fraud that is misclassified as bad debt. Here are some of the studies that I have participated in the past to uncover bad debt losses.

Finding Hidden Mortgage Fraud Losses

CoreLogic, Interthinx and DataVerify have analytic models that can be used to score every application and funded loan for likelihood of fraud.

To find bad debt simply run the models on historic default populations (I recommend sample sizes of 500 defaults or more) and send the high fraud scoring transactions to a fraud analyst or underwriter to perform a full manual underwrite.

After review all of the applications that have high scores you will probably find a percent of applications that have material misrepresentation in the application. My estimate is that you will have at least 30% of the applications with fraud.

Using this knowledge you can assess your level of hidden fraud on your mortgage portfolio,

Finding Hidden Auto Fraud in Your Lending Losses

PointPredictive, Equifax, Experian and TransUnion have scoring tools that can help you assess the level of risk on your default portfolio.

Using the same techniques as you did with Mortgage, I recommend retro-scoring a significant population of loans to identify the applications that contain fraud.

My estimates are that you will detect between 30% and 50% of your early default loans will contain some element of misrepresentation in the loan file.

Finding OverLimit Fraud that is Hidden

A good rule of thumb for over limit losses on card portfolios and DDA accounts is to use a standard overlimit amount of 130%.

Accounts that exceed their limit by over 30% have a marked decrease in cure rates. This sudden dip in cure rates often suggest that there is some intention to defraud in the activity that lead up to the over limit status of the account.

FICO has done extensive analysis on First Party Fraud Models and there analysis suggest the high correlation between high overlimits and fraud.

Check out the chart here

Finding Synthetic Identity Fraud in Hidden Bad Debt

One of the leading companies in detecting synthetic identities is a San Diego based company called ID Analytics.

ID Analytics has models that precisely identify the dynamics of synthetic id’s which are problematic in underwriting. Since there are typically no victims that report the fraud, synthetic identities may make up 20% of the bad debt sitting in your default losses.

For an assessment of your synthetic identity problem, I recommend contactin ID Analytics to see what they can do for you.

Why Find Hidden Fraud?

Companies that search for hidden fraud in their default losses are able to reduce their credit risk losses significantly by using a fraud approach rather than relying on traditional credit risk practices that fail to stop the fraud.

By carving out the fraud applications from the credit risk applications you can better identify and prevent the fraud before it hits your books.

Thanks for reading as always.

Frank McKenna is the Chief Fraud Strategist for PointPredictive and a Fraud Consultant based in San Diego California

Republished with permission of “Frank on Fraud”