August already marked the highest auto loan delinquency rate since March of 2020.

Stocks and fuel prices are up and down, Delinquency is… well, that’s the trillion-dollar question (adjusted for inflation) that everyone in the collections and recovery world really wants to know. A question soon to be answered as the nation’s largest banks brace to report their 3rd quarter 2022 financial result to investors this Friday.

Q2 financial reports from everywhere from the Fed to the NCUA have already shown that the aberrantly low pandemic era delinquency trends have passed and we have been experiencing a return to normalcy in relation to delinquency. But by the time these numbers were released, new trends were exposing themselves. Trends not necessarily backed up with data, but trends felt by collectors and recovery professionals all across the nation regardless.

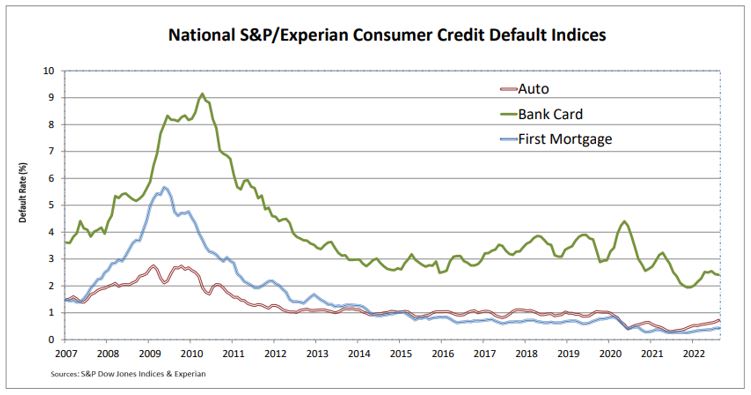

August’s month end auto loan delinquency data was already reported by the S&P Dow Jones Indices on September 20th as finishing at 0.72%. This was a six-basis point increase from the previous month and more than double that of August 2021’s .34%.

This is the highest auto loan delinquency rate since March of 2020 and illustrates that we have already reached pre-pandemic levels.

Interesting enough, auto loans were the only segment of delinquency that had shown and increase over that month and neither First Mortgages nor Bank Cards showed any major increases from the year before. The S&P Dow Jones Indices report their data on the third Tuesday of every month.

Three of the five major metropolitan statistical areas (“MSAs”) showed higher default rates compared to last month. Dallas had the largest increase, up seven basis points to 0.69%. Miami and Chicago each rose three basis points, to 1.16% and 0.70% respectively. New York and Los Angeles each dropped seven basis points, to 0.58% and 0.45% respectively.

One interesting outcome that could reveal itself, is if Ally Financials’ repossession strategy reported in their 2nd quarter earnings call shows any results. If you may recall, Ally’s Chief Financial Officer, Jenn LaClair, had answered a question regarding increases to their 60-day delinquencies which had shown an increase to 2019 levels.

In her response she stated; “So I made note of one of those around repossession timing, which is essentially just giving our customers a little bit more time to pay. We have had tremendous success with that approach, and that just keeps that 60-day number up temporarily as we are rolling through this new policy. But it’s normalization of the portfolio as expected. There is some seasonality in there from a delinquency perspective and then some policy changes that are driving that growth.”

So, come Friday, when the 3rd quarter of 2022 data is released, we will begin to see just how valid these trends are. And just as important, we will perhaps get a glimpse of what is to come. Scheduled to release their end of quarter results on Friday are Wells Fargo Bank, JC Morgan Chase and CitiGroup to name only a few of the largest.

All eyes on Friday’s Q3 delinquency data – Collections – Delinquency