Car segment valuations getting hit the hardest

Remarketing strategies are varying from seller to seller and last week, we saw some sellers adjusting floors and off-loading inventory, while others held firm to floors. Repossessions are beginning to show up in the market and with fuel prices returning to a level last seen in February of this year, the Car segment valuations are taking the hardest hit.

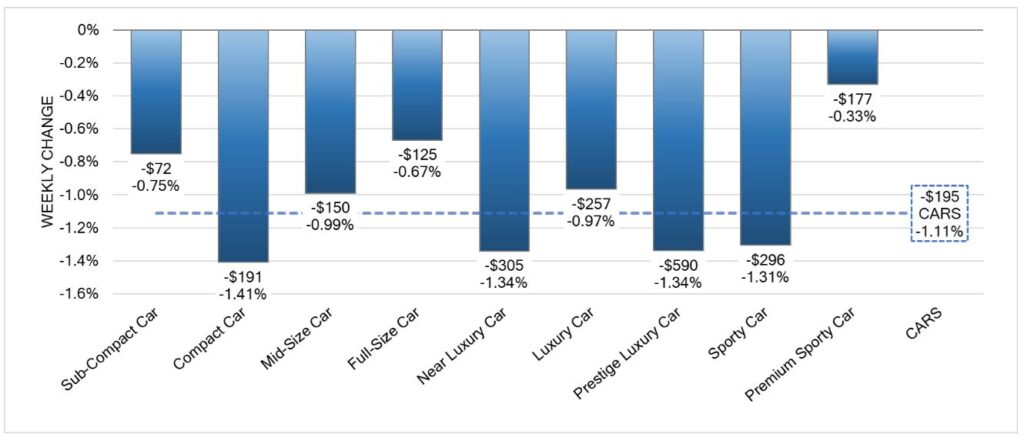

Wholesale Prices, Week Ending October 15th

- On a volume-weighted basis, the overall Car segment decreased -1.11%. For reference, the previous week, cars decreased by -0.66%.

- All nine Car segments decreased last week.

- Four segments reported declines greater than 1% last week: Compact Car (-1.41%), Near Luxury Car (-1.34%), Prestige Luxury Car (-1.34%), and Sporty Car (-1.31%).

- Premium Sporty Car reported the smallest decline at -0.33%.

- Sub-Compact Car (-0.75%) had the largest single week decline for the segment since August 2021.

Weekly Wholesale Index

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last 2 years. We saw a similar picture in 2009, at the end of the Great Recession.

Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for the majority of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December 2021, reporting over 1.51 points.

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Wholesale

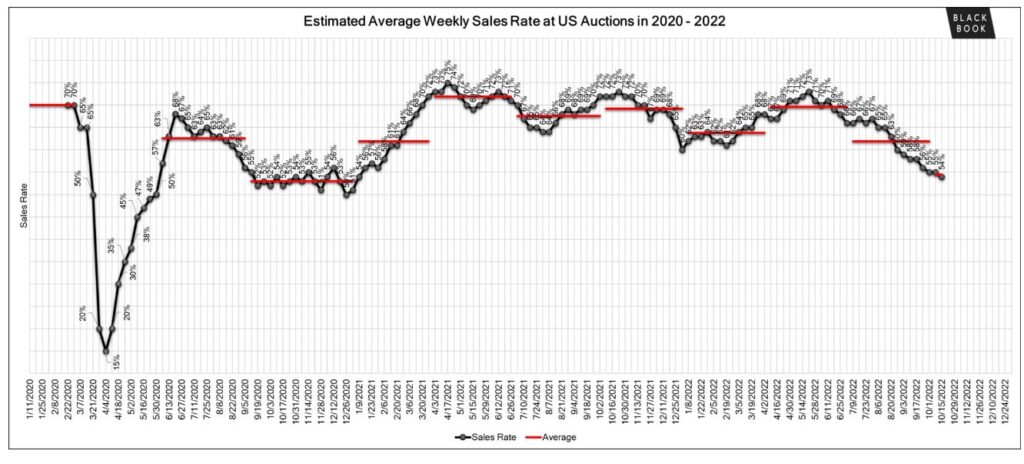

The Estimated Average Weekly Sales Rate dropped to 54% last week.

Floors are still high, but buyer count is stable. The inventory is there and has been consistent over the last few weeks. Some sellers seem to be adjusting their floors and are off-loading inventory, while others continue to hold firm to floors.

Many buyers continue to hold out for lower prices or better condition vehicles, but others were actively online competing. Large independent dealers and rental companies were very active challenging each other to the best bid. Franchise dealers were still bidding, but the large independent dealers and rental companies seemed to dominate over them.

Overall, sales rates were down this week, but certain lanes had higher sales rates than we have recently seen. This could potentially mean that sellers will soften their floors and sales rates could potentially get better. We still have not seen flood vehicles from the hurricane coming through yet, but there is speculation that a lot of cars were damaged, and they will be coming through the lanes soon.

Moving into the fourth quarter, we anticipate an increase in repossessions being offered in auction lanes and we are starting to see more coming through. Overall, it was another stable week with the market still decreasing.

Read the Entire Report Here!

Source: Black Book

Black Book reports repossession inventory on the rise – Repossession – Credit Union Collections – Credit Union Collectors

Black Book reports repossession inventory on the rise – Repossession – Credit Union Collections – Credit Union Collectors

Facebook Comments