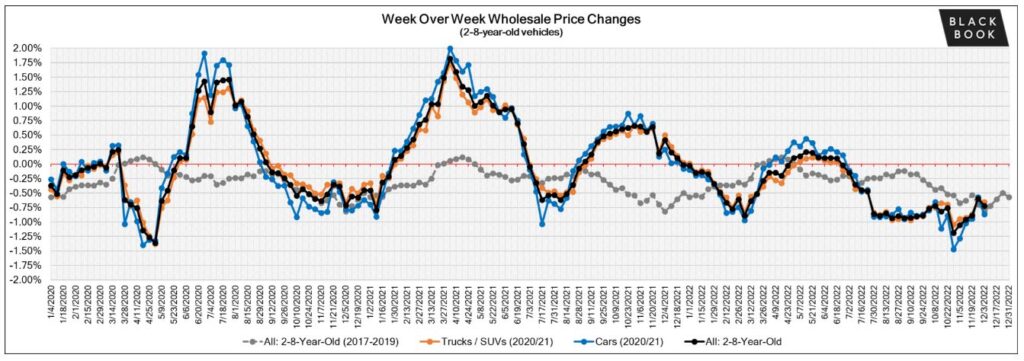

Wholesale Prices, Week Ending December 3rd

After the slowdown in depreciation during the week of Thanksgiving, the depreciation picked up the pace once again last week, but the overall market did not experience the level of declines seen before the holiday. The level of decline last week was more on par with what is typically expected for this time of year.

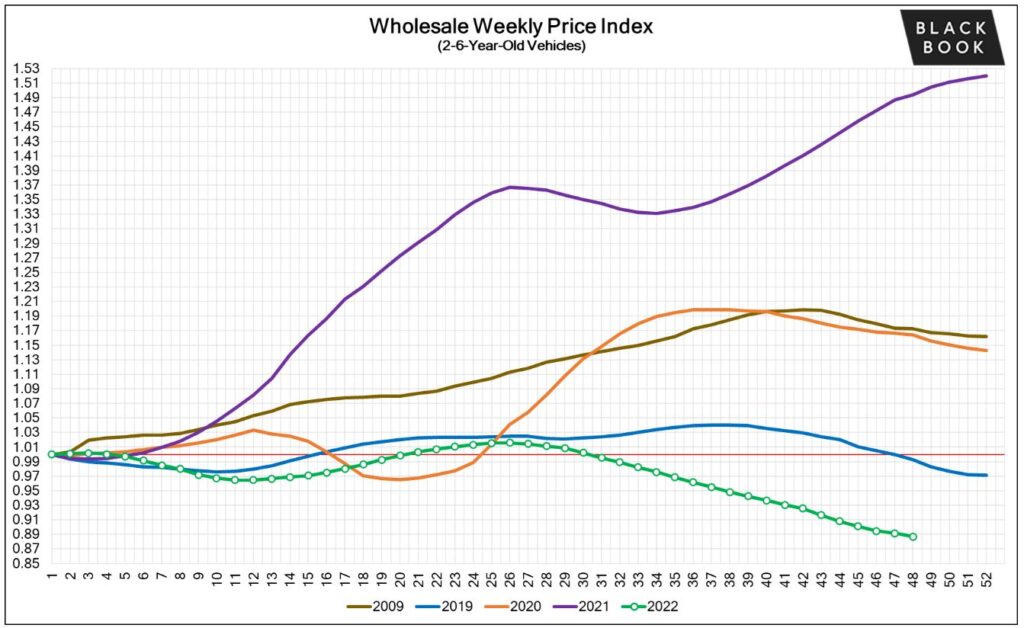

Weekly Wholesale Index

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last two years. We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for the majority of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December 2021, reporting over 1.51 points.

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Wholesale

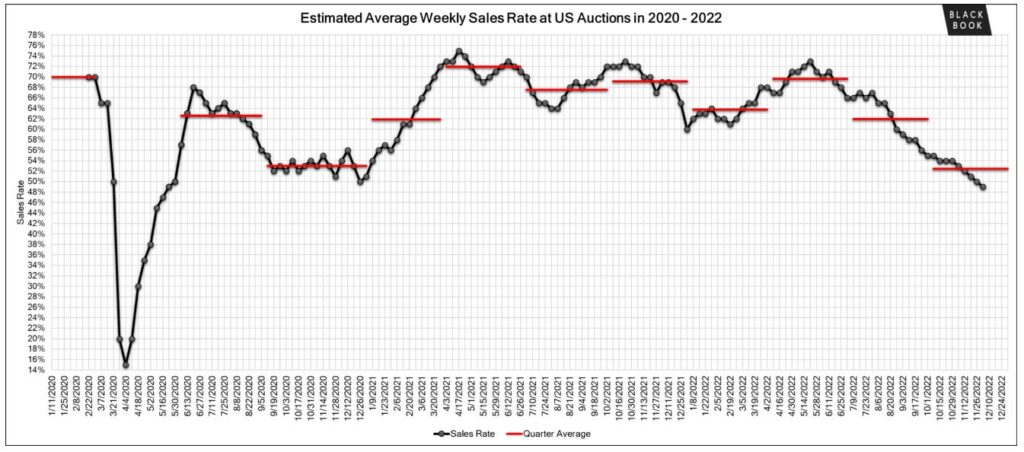

Auction lanes showed increased activity this week but are still slower than normal overall. Buyer count was consistent with prior weeks, and they were hoping to be able to negotiate. Some buyers were physically in the lanes, but most were online. Sales rates seem to be down this week.

There are still some “If” sales coming through so some sellers are willing to negotiate for the right price. Inventory count is overall still down, but consistent, which might be why some sellers are not willing to negotiate. After a short absence, rental companies came back this week strong in the lanes.

Large independent dealers and rental companies were very competitive with each other, while it seemed like the smaller franchise dealers stepped back a bit this week. There are still very few Model Year 2023 vehicles coming through the lanes, but we anticipate seeing more in the near future. Overall, wholesale values are continuing to decline. We do not expect much to change for the rest of the year.

Read the Entire Report Here!

Source: Black Book

Related Articles:

Black Book reports repossession inventory on the rise

Wholesale auto market declines for 10th straight week

Black Book Breaks Another Record in Used Vehicle Value Retention Index

December Auto Wholesale Slide Kicking In – Repossession – Credit Union Collections – Credit Union Collectors