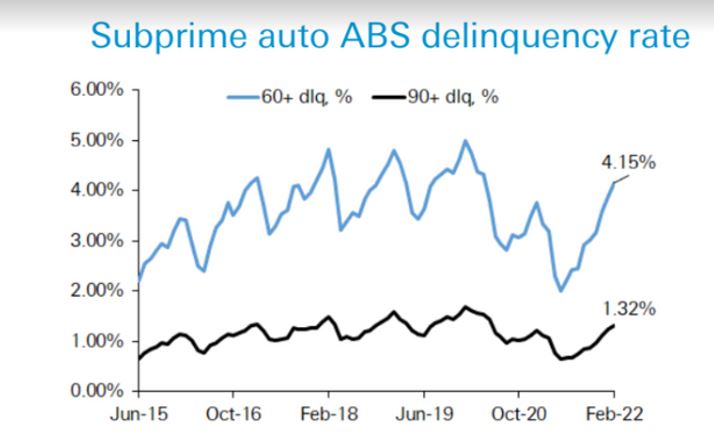

Smell Fire? Subprime auto loan delinquency climbs to highest rate since April 2020

Now that pandemic economic subsidies have disappeared and inflation has climbed to a forty year high, the tide of delinquency may be creeping in. According to Deutsche Bank, subprime auto loan delinquency over 60 days delinquent hit 4.15% in February. The highest level since April of 2020. The peak of the pandemic.

Despite high unemployment during the pandemic, subprime auto loans had been surprisingly strong. This was obviously sustained through taxpayer funded subsidies from Washington combined with record numbers of loan modifications and extensions.

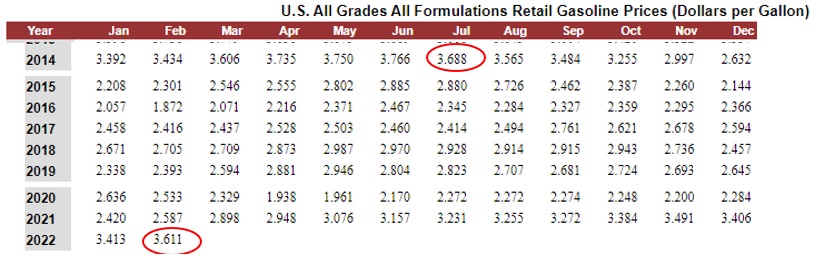

But like all things that rise, they must eventually come crashing back down. At month end February, the national EIA average was fuel price was $3.61, the highest since July of 2014, when it was $3.68 (an adjusted current value of $4.38). And that was before the effects of the war in the Ukraine hit the shores of America. With today’s AAA national average at $4.23, it’s clear that the pain has only just begun.

With one-third of Americans earning $15 an hour or less, it is easy to see how financially painful this is for the average American. Unfortunately, under the current administration and their untenable position against domestic oil production, it is probable that this trend will only worsen.

The February 2022 numbers are based on subprime loans packaged into asset-backed bonds, this has serious potential to turn into a serious dumpster fire that could creep into other credit tiers as the hyperinflated economy persists.

While this February 2022, 4.15% delinquency ratio may seem high, to keep perspective, delinquencies for the same category in 2019, before the pandemic, averaged 5.2%.

Is this a return to normalcy or merely a market correction? Time will tell, but as long as inflation hovers at 7-8% or higher and oil prices hold strong at over $100 a barrel, the economy will see little relief. And, the stress of this economy will continue to punish the lower income population the hardest. And these numbers will continue to slide.

Will we experience another tsunami of loan modifications and more Federal handouts to offset this? Who knows, but as long as the current Federal oil policies remain in place and international instability persists in the market, the investment powers that drive oil prices will remain high. And with fuel affecting every aspect of the American economy, increased hardship appears probable.

Source: Marketwatch

Has the subprime auto dumpster fire started? – Credit Union Collections – Credit Union Collectors

Facebook Comments