“Potentially, the biggest financial crisis ever” – Elon Musk

Skyrocketing interest rates coupled with panic buying are creating the making of what could be the biggest financial crisis ever, according to many experts including Tesla CEO and founder Elon Musk. Adding fuel to the dumpster fire are wholesale depreciation and stubborn record high inflation that are creating a demotivating environment to maintain payments. The vast majority of financial experts see a recession coming. Just how bad will this be?

On the Front

A couple of months ago, I had a dealer from Oxnard, California call me needing a quick loan approval on a Dodge truck valued at roughly $105K. The buyer was trading in his SUV with $15K in equity and put another $50K down. The dealer marked up the front-end sale price of the vehicle to $145K.

Hit with California sales taxes of roughly 10%, licensing fees and the LTV came up to about 105%. Without disclosing my loan decision, I will tell you, I fought every moral instinct in me to call the buyer direct and tell him to run for his life. But this is the market that was going on a couple of months ago and it was happening almost daily.

Hate it if you will, they’re car dealers. It’s what they do. It’s what they’ve always done. They profit well from needy buyers and there’ve been many out there over the past year.

Even if I had warned that borrower, it’s unlikely my warning would have dissuaded him. There’s a panic over rising interest rates and limited supply that’s chummed the waters for dealers all across this nation. Emotions overrule logic in such situations and decisions are often made that feed into a similar buyers’ market that led to the housing meltdown of the Great Recession.

The Big Chill

With inflation at 40-year record highs, the Fed has been trying to cool this market with 7 rate increases to the prime rate this year alone. And with so far only minor improvements to inflation, they are very likely not done. How many more will occur in 2023 is yet to be seen, but the unemployment and a cooling auto market are almost inevitable.

While this may seem to be a panic tactic to some, reality is, rates had been held too low for too long. These rates were brought down to spur the economy into recovery in the aftermath of the Great Recession, but never eased back to a rate of normalcy. So here we are once again in an economy spoiled by untenable interest rates and a fear driven economy.

These musings on the current state of the auto industry are not just my own. Far more knowledgeable and credible sources than myself are chiming in.

According to Edmunds.com; The average annual percentage rate (APR) for financing a new vehicle climbed to 6.3% in October 2022, compared to 4.2% in October 2021. This is the highest APR for new vehicles since April 2019, well before the pandemic. Likewise, the average used vehicle APR jumped up to 9.6% in October 2022, compared to 7.4% in October 2021, the highest since February 2010. Just after the Great Recession.

To offset these increased monthly payments, buyers are extending their loan terms. Edmunds reports that that the average loan term of 73 months or greater increased to 34% in October 2022. A 7% increase from 27% in October 2017.

“The last time interest rates were this high, consumers could at least rely on lower vehicle prices and a greater range of inventory to soften the blow,” stated Jessica Caldwell, executive director of insights at Edmunds.com. “That simply isn’t the case in this market.”

Anonymous Observations

According to Twitter posts from CarDealershipGuy, an anonymous and well followed account held by the CEO of a car dealer group; “I’m now convinced that there is a massive wave of car repossessions coming in 2023.“

CarDealershipGuy went on to explain;

1) Consumer takes out an auto loan in 2020/2021 on an overvalued car

2) 2022 comes around and that overvalued car is now rapidly declining in value

3) With the car declining in value, consumer now owes more on the car than it is worth

4) Consumer no longer wants the car. Maybe they outgrew it. Or maybe it keeps breaking. So consumer wants to trade it in.

5) But dealer can’t trade the car in because the consumer owes WAY too much on it. So dealer asks consumer for lots of money down to cover the difference.

6) But of course, the consumer doesn’t have $1,000s to cover the difference between what they owe on the car and what it’s worth.

And here comes the perfect storm…

7) Dealer can’t sell consumer a car, Consumer can’t buy a car, And, you guessed it, lender can’t finance a car!

Everybody loses! Oh no. So what happens next?

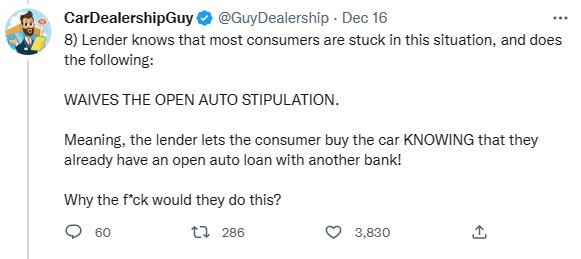

8) Lender knows that most consumers are stuck in this situation, and does the following:

WAIVES THE OPEN AUTO STIPULATION. Meaning, the lender lets the consumer buy the car KNOWING that they already have an open auto loan with another bank!

Why the f*ck would they do this?

Surely the lender knows that consumers that take out a 2nd auto loan are MUCH riskier and have a MUCH high risk of default? Right?

RIGHT?

Yes, but the lender does it because they know that the consumer will default on the other car !!!!

Dog eat dog style.

Let me be clear: This is NOT normal.

But it’s the only way lenders can finance cars and dealers can put cars on the road.

And the implications of this will be tons of repossessions.

I’ve been a doubter, but after what I saw this morning, I’m now FULLY convinced that a wave of car repossessions will hit in early/mid 2023.

If lenders are willing to backstab each other in order to put more loans on the road, we’re in trouble.

This will not end pretty.

When the CEO of an auto dealership group, whose income and profession are reliant upon “pushing metal” finds the current trend disturbing, it’s probably a good idea for everyone to take notice.

Pressure to Lend

At the same time, as inflation and rising interest rates take their toll, over the past two months auto sales have slowed and qualified loan applications with them. Lenders of all types, still have budgets to make. Budgets cast earlier in the year or last year that their bonuses and end of year evaluations will be based on.

As the result, some lenders are prone to look at more applications with rose colored glasses or simply choose to make exceptions and allowances in order to keep the motor running into years end with hopes of the short-term survival of their careers and employment of staff. Lending staff whose positions risk elimination when the market tanks.

We all saw this cycle during the Great Recession and to a degree, it appears to be repeating itself. Fortunately, these are smaller short-term loans and not massive long term loans involving people homes and lifetime investments. Regardless, they do have an impact on the economy.

Car Values on the Slide

In case you haven’t been following my monthly reports of wholesale auction trends from Black Book, wholesale auto values have been on the slide for months now. While seasonally, the fourth quarter has always trended to be the worst period of the year, this trend started last summer.

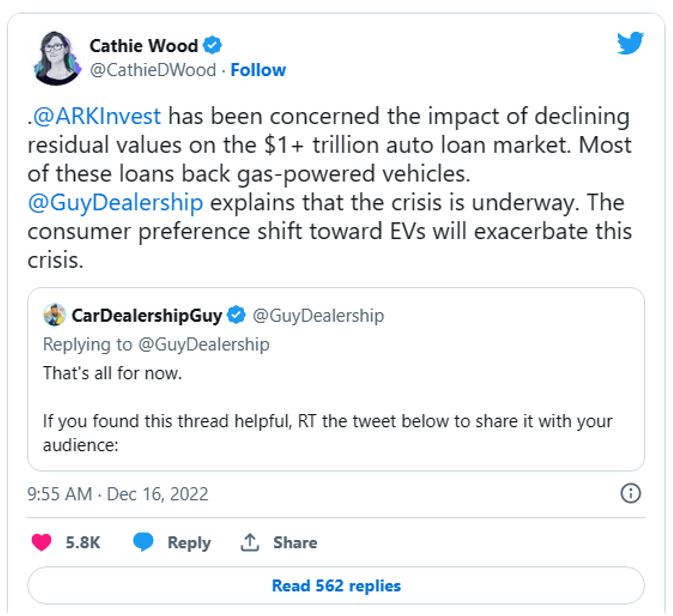

Exasperating this trend is the shift to EV’s spurred by both high fuel prices and social pressures. On December 15th, Celebrity Investor Cathie Wood responded to CarDealershipGuy’s thread with the following;

“@ARKInvest has been concerned the impact of declining residual values on the $1+ trillion auto loan market. “Most of these loans back gas-powered vehicles. @GuyDealership explains that the crisis is underway. The consumer preference shift toward EVs will exacerbate this crisis.”

Even Tesla CEO and now owner of Twitter Elon Musk responded to this thread with the following;

“Potentially, the biggest financial crisis ever”

Of course, Elon Musk has become a very polarizing man since his purchase of Twitter and unmasking of their politically driven back-room policies. But let us not forget that just a few years ago, he was the media’s darling and the Tesla auto company was the flagship of the EV revolution. Love him or hate him, he’s a hyper-intelligent individual worthy of an objective ear.

Red Flags

Red flags are being waved from all corners of the auto industry and beyond the normal click-bait stories, the national press is beginning to notice. On December 17th, NBC News posted an article titled “Car repossessions are on the rise in warning sign for the economy.”

In this article, they also quoted Edmunds.com’s Ivan Drury, director of insights; “These repossessions are occurring on people who could afford that $500 or $600 a month payment two years ago, but now everything else in their life is more expensive. That’s where we’re starting to see the repossessions happen because it’s just everything else starting to pin you down.”

Drilling down to the repossession agency level, they interviewed well respected repossession agency President Jeremey Cross of International Recovery Systems in Pennsylvania, who stated;

“Right now, it’s really the perfect storm,” said Cross. “Over the last two years, vehicle prices were inflated because there was no new car supply, people were still buying like crazy because they had a lot of stay-at-home cash, they had inflated credit scores, so it was like a recipe for disaster.”

History Repeating

You would think that 14 years after the Great Recession, we would have learned the warning signs along the way. But alas, here we are and history seems to be repeating itself in at very least this level.

But let us not forget that after World War I, the Spanish Flu Epidemic kicked in. And nine years later, The Great Depression. I’ll just leave this there.

Kevin