Insurance coverage requirements vary significantly from one creditor to the next. Although the insurance industry provides coverage in the trillions of dollars, repossession is a $50MM niche market. Unfortunately, many insurance carriers and professionals struggle to understand this unique industry and many times are unable to provide the insurance these agents are asked to carry.

Recently, RISC was asked to provide an analysis to creditors about common expectations and baseline requirements for repossession insurance. RISC performs vendor vetting compliance services to more than 40 creditors and national forwarders across the U.S. and monitors over 2,000 repossession agencies. RISC’s vetting services includes reviewing agencies’ insurance policies and puts us in a unique position to observe trends in this critical area of compliance.

Recent trends of non-standard requirements include the waiver of subrogation on an employer’s liability insurance and cyber liability limits of $5MM per occurrence. For the waiver, only a small handful of lenders ask for this, but carriers will almost always deny this request as it puts them in an unenviable position. For the requirement of a cyber liability insurance limit of $5MM per occurrence, recovery agents simply do not have these limits, and finding a repo agent who will obtain and pay for a policy with this requirement is challenging. Another request that is unusual is Professional Liability, also known as Errors and Omissions (E&O) with a limit of $5MM per occurrence. Again, repossession agencies do not carry a policy with that high of a limit. Generally, agents maintain limits according to their service level agreements with their clients and they vary from no required limit to as high as $1MM per occurrence as seen in the chart below.

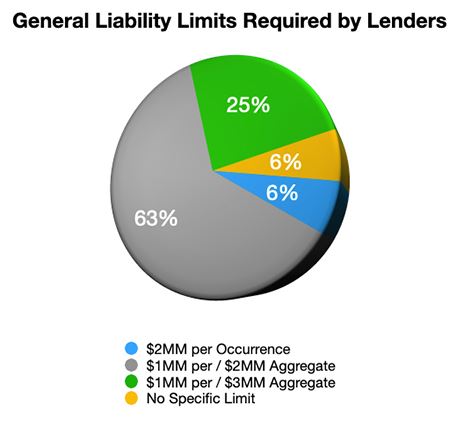

Despite these unique expectations, commonality does exist. Of the 40+ creditors that RISC supports for vendor vetting, 63% require a Commercial General Liability insurance of $1MM per occurrence and $2MM general aggregate, and 25% require limits of $1MM per occurrence and $3MM general aggregate. Only 6% require a $2MM per occurrence coverage, and another 6% have no specific requirement on limits.

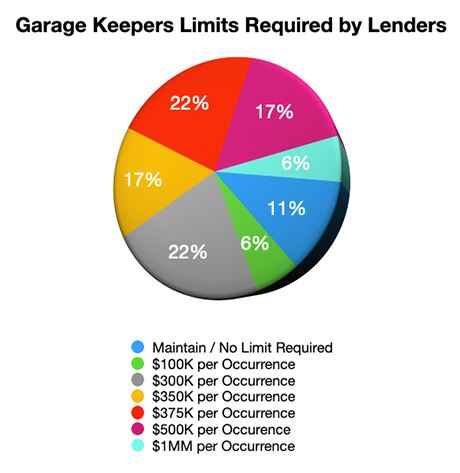

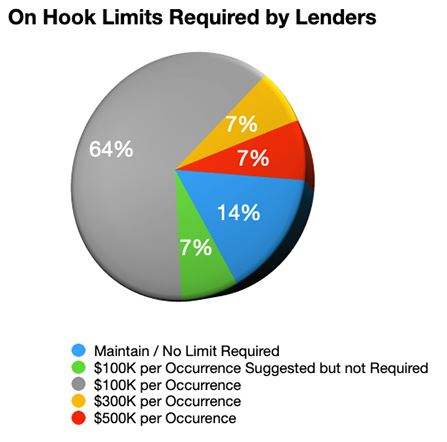

Similarly, all of RISC’s creditor clients require Vehicle Liability insurance covering owned, non-owned, and leased vehicles of not less than $1MM combined single limit. In addition to the major coverage requirements, creditors have varying limit requirements for garage keepers, on-hook, and wrongful repossession coverages, as seen in the following charts.

The most important takeaway from our observations regarding insurance for repossession agencies is that there are very few insurance providers in this industry. Creditors need to be aware of nonstandard requests that are near impossible for agents to obtain or afford. Creditors may need to be prepared to pay agencies a premium if they want to demand these out-of-the-ordinary coverage requirements.

RISC is the leading authority in the compliance services industry for collateral recovery. We provide education, vendor vetting, and lot inspection services for clients across the country. If lenders or national forwarding companies have additional questions about insurance coverage standard practices, please contact RISC at support@riscus.com or call (813) 712-7535 to start a conversation with an expert.

DISCLAIMER: Limits defined in the statistics from the charts above are based on an average of RISC, LLC’s more than 40 vendor vetting client requirements. These are not intended to provide legal advice to creditors or claim to be legal standards, but rather are intended to show potential trends.

by Holly Balogh : RISC / President

As President at RISC, Holly manages the internal and external operations of the business, and leads the team while working within all areas of compliance. Working to optimize RISC’s education, vendor vetting and onsite inspection services, Holly ensures that the products are delivered seamlessly from initial document review, to customer delivery. In addition, Holly is the main point of contact for all of RISC’s stakeholders, vendors and third-party providers. As a veteran of the collateral recovery industry, Holly’s deep understanding of the marketplace and natural ability to look at the big picture enables her to design and guide strategic solutions. Holly holds an M.B.A. from Bradley University, Cum Laude, and has worked in technology development, strategic operations, and management for companies as diverse as large fortune 50 and small start-ups for more than 30 years. Connect on LinkedIn

Facebook Comments