January Auto Delinquency Even Worse than December per Cox Automotive

By tradition, December auto loan delinquency tends to be the worst of the year. Blame Christmas spending, slow mail or extra time off if you will, but it almost without exception comes down in January. That tradition appears to have come to an end as January’s auto loan delinquency rates rose across all categories. Worse yet are the developing trends in borrowing and rising debt.

No Signs of Slowing

According to Jonathan Smoke, chief economist at Cox Automotive, auto loan delinquency in the month of January showed further deterioration to credit performance. Overall, the delinquency rate for auto loans 60 or more days past due (reportable) rose by 2% and was up 20.4% from the prior year.

Of all delinquent auto loans, 1.89% were in a state of severe delinquency. This represents a 1.84% increase over December and is the highest rate in the data series going all the way back to 2006, just before the Great Recession.

Overall severe delinquency was 38 basis points higher than a year earlier in January. Subprime auto loans showed a 7.30% severe delinquency rate, which is an increase from 7.11% in December and a 156 basis point increase from the same time last year. This was as well, the highest since 2006.

While these high levels of severe delinquency have not yet transpired into an equivalent level of defaults, they are growing. January’s defaults increased 6.2% over December and were up 33.5% from the prior year. The annualized default rate for January of 2023 was 2.72%, while still lower than pre-pandemic January of 2019’s 3.24%, it was an increase of 2.28% in 2022 and 1.98% in 2021.

Underwater

All of this auto loan delinquency that eventually goes into default creates losses for the lenders once they hit the auction block. These losses, created by the delta between value and balance owed is driven by a number of factors outside of supply and demand at the auction. But one of these most startling factors is what is happening at the dealership.

According to the experts at Edmunds, there is a marked increase in the numbers of vehicles traded in with “negative equity”; cars traded in whose value is less than the payoff. This number has increased from 14.9% in 2021 to 17.4% in 2022. Worse than that, the negative balance carried into the new loans increased from an average of $4,141 in 2021 to an average of $ 5,341 in 2022.

Add that negative equity onto a vehicle sold at a retail price with higher interest rates and it is easy to see that when these defaults hit, the losses will be larger than usual. Increase the volume of collateral for liquidation at the auction and the laws of supply and demand will toss gas on this dumpster fire as their wholesale values begin to plummet.

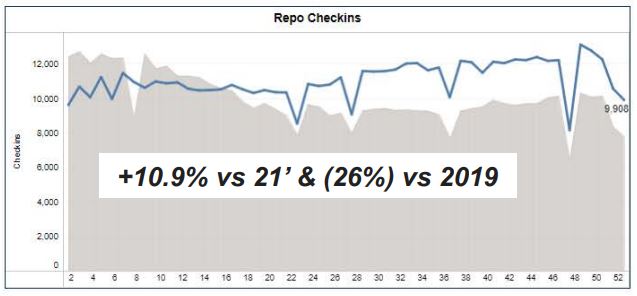

And according to Manheim’s quarterly market report, repossession check ins at the auctions are already beginning to rise. They report that in 2022, the numbers of repossessed units checked in had risen 10.9% over 2021 and 26% higher than pre-pandemic 2019. As their chart shows, it has been a gradual climb, much like the delinquency preceding it.

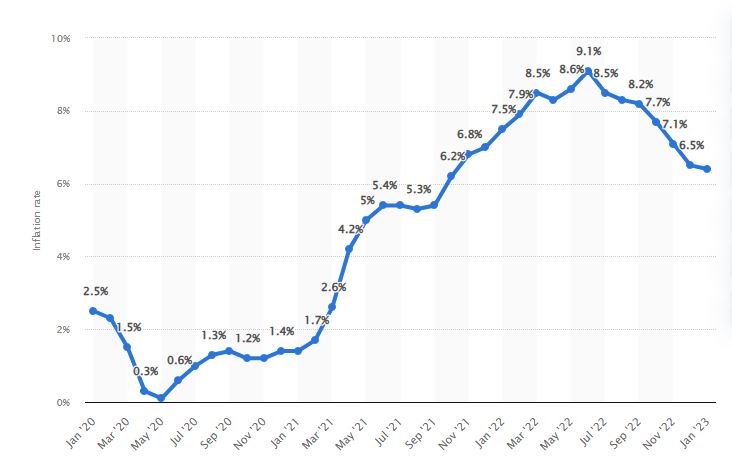

Regardless, wholesale values have been holding strong. But that strength is likely to diminish as rising interest rates to fight the high inflation create additional stress to the consumer wallet. A wallet that’s been under a great deal of strain over the past year.

A Trillion in New Debt

According to Experian, American consumers ran up more than $1 trillion in new debt in 2022. This is a level of increase in consumer debt not seen on over a decade. Driving this 7% increase was inflation and increases in consumer demand from a nation at near full employment levels whose spending patterns have yet to cool.

All the while, the Fed keeps cranking up interest rates and driving up the need to borrow in order to keep up these patterns. With interest rates on variable rate credit cards near 20% and increases in personal loan activity, the strain on the consumer wallet is beginning to show. In 2022, personal loan balances grew 30.9% to $174.22 billion.

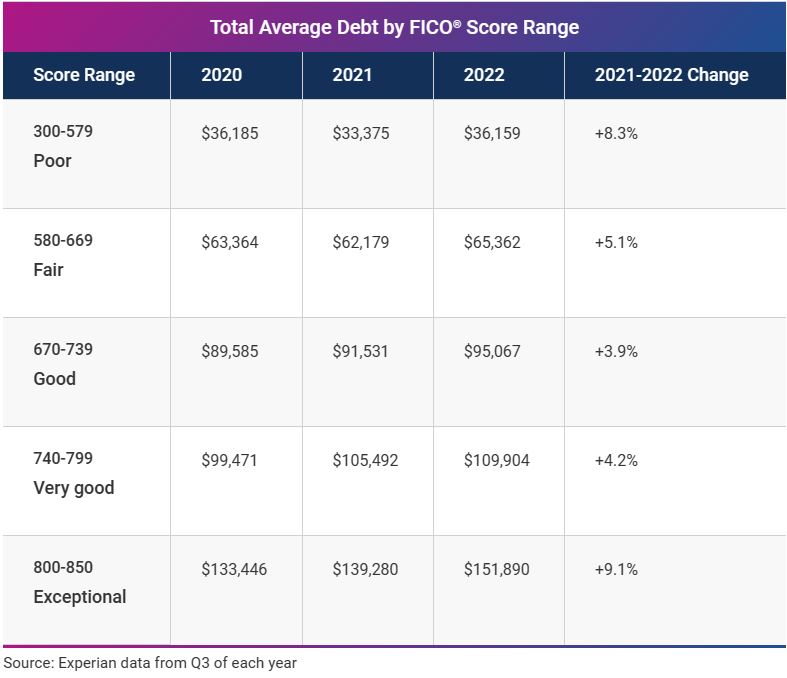

As evidence to the universal impact of inflation and rising interest rates, no state, age group or credit score tranche were immune. 35% of all U.S. consumers saw an overall increase in average debt by 3.9% which was $95,067 last year. Of the states hardest hit were the Western states, with Idaho and Utah leading the nation. Of the lowest increases were Oklahoma and Connecticut.

If you were to think that credit score tranches in the subprime areas would have shown the highest increases, you would be wrong. Subprime scores between 300-579 showed an increase in debt by 8.3%, but super-prime scores of 800-850 rose 9.1%.

And one more wild card sits out there with the $1.7T in student loan payments on perpetual hold since the start of the pandemic three years ago. While millions of persons holding these debts may be hopeful that the White House’s efforts to erase them will pass the Supreme Court, it is unlikely at this point. Should these debts be reactivated, we will see yet another financial strain placed on the economy.

People are dipping into their savings to keep up with the basic cost of living, but those are the ones fortunate to have savings. 42% of all Americans have less than $1,000 of savings and 10% have none. What little savings that 42% have won’t last long if inflation maintains its current 6.4% year over year average.

And with the Fed’s plan to cool inflation through rising interest rates, it seems unlikely that it will be achieved without a considerable contraction in the job market. And with that, rising unemployment and more gas poured on the fire of rising delinquency.

On the Edge

All of these data points are rising like little red warning flags. While no one individual data point has proven sufficient is stoke panic, none should be ignored. All of these data points are correlative to a larger trend. The auto market is showing signs of a growing stress.

The equity bubble in collateralized auto loans is already bloated and unlikely to improve anytime soon. Escalating interest rates coupled with inflation are driving up debt and financial strain on the economy. Unfortunately, interest rates will continue to climb until inflation is in check, and it’s not even close.

Many if not most believe that inflation will not come to heel until unemployment numbers increase. And if they get their way, it will be on the backs of an unemployed society, a society of people buried in auto loans worth far less than they paid for.

Watching delinquency climb and the equity bubble in auto loans swell has been like watching a slow-moving ship heading into an iceberg. You can see it happening, but there’s really nothing much you can do about it more than sit and watch and hope that you don’t get caught up in it. Month after month, the signs worsen and before too long, we may find ourselves in a deep recession. It looks unavoidable.

But don’t hold your breath for someone to announce that we’re in a recession. Last year, the White House chose to redefine it from the older definition of “two consecutive quarters of falling real GDP” to “a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes.” Unfortunately, as we get closer to an election year, the harder the fight to avoid waiving that white flag of surrender will be, so don’t expect the experts to tell you we’re in trouble.

Not that any of that really matters, you don’t need a meteorologist to tell you that it’s raining. You only need to stick your head out the window and look for yourself. Watch for the red flags, make your own determinations, watch your data closely and act proactively. We may be in for a long bumpy ride.

Related Articles:

Where Are All the Collectors Going to Come From?

US Consumer Credit Grows $11.6B

December 22’ Auto Loan Delinquency Data – Worst Since 2009

Experian Reports December 22’ Auto Loan Default Rate at its Highest Since February 2020

Red Flags Rising in Auto Delinquency – Troubling Trends – Delinquency – Repossession History

More Stories

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2

Talk Derby to Me at the NWCUCA 51st Annual Conference

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk