States with Highest Auto Loan Delinquency in Q3 2023

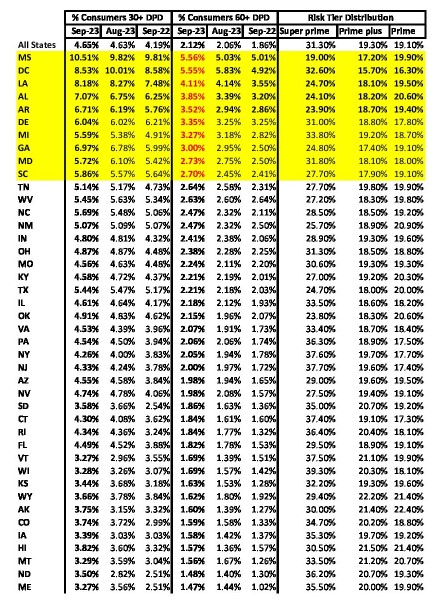

Earlier this month, TransUnion, one of the nation’s largest credit reporting agencies, released their September 2023 Credit Industry Snapshot. Within its contents they laid out by state, the 30-day and 60-day delinquency ratios by loan type for all 50 states. Come see which states have the highest auto loan delinquency ratios.

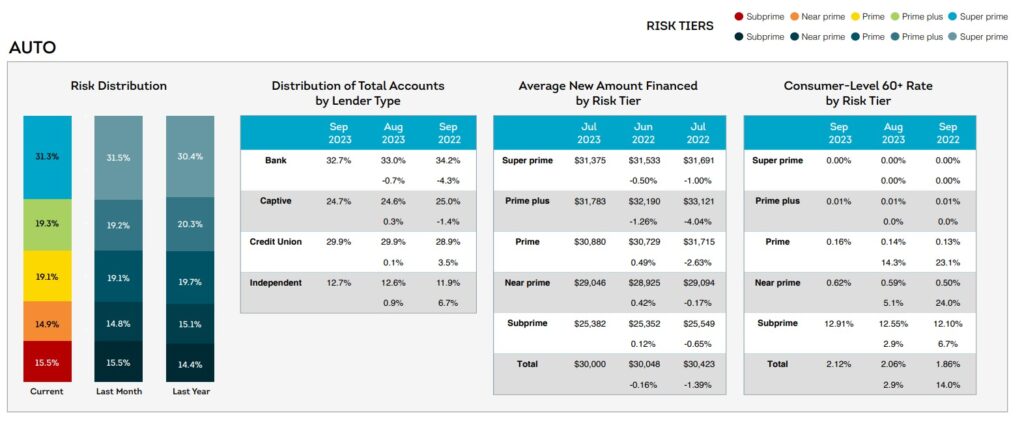

Before we reveal the states with the highest auto loan delinquency, TransUnion provided some higher-level perspective on the month over month changes to auto loans reported in their vast database of credit reporting information.

Auto – National

→ Consumer 30+DPD increased to 4.65% (2 bps); 60+DPD increased to 2.12% (6 bps)

→ Average amount financed declined slightly to $30,000 (from $30,048); its first decline following three consecutive monthly increases.

Keep in mind, these are month by month changes. When you see the larger data, you will see some surprising variances from August, but also variances from September of last year.

Auto Loan Concentration

Month over month, the changes in 60+ day delinquency concentration by FICO tiers is fairly nominal, moving at about 2 bps at the prime level and up to almost 40 bps. But looking at the year-over-year changes, you can see that it is more dramatic with an average 26 bps increase overall.

As delinquency ratios go, these are still fairly modest and just slightly above pre-pandemic levels and resembling the downside of the Great Recession.

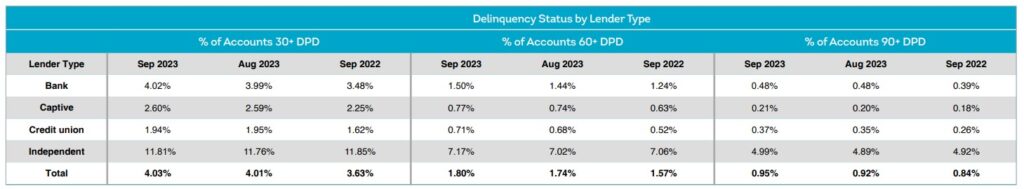

Auto Delinquency Ratios by Lender Type

With all the recent headlines about rising subprime auto loan delinquency, TransUnion’s report that Independent lenders delinquency ratios are so high should come of little surprise. While Credit Unions are doing very good, the Captive lenders have got it best.

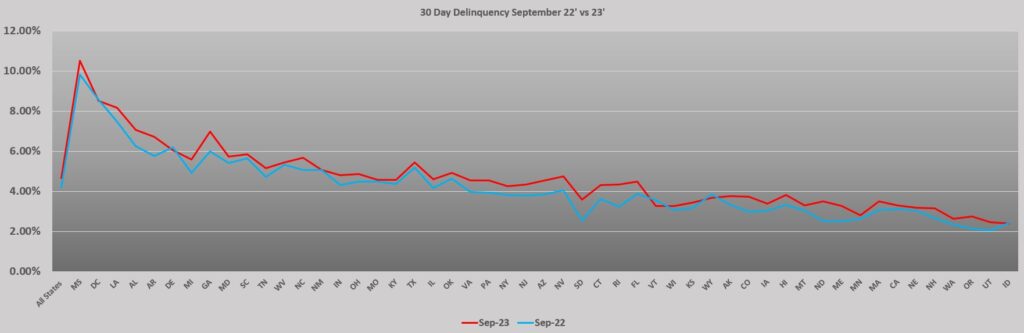

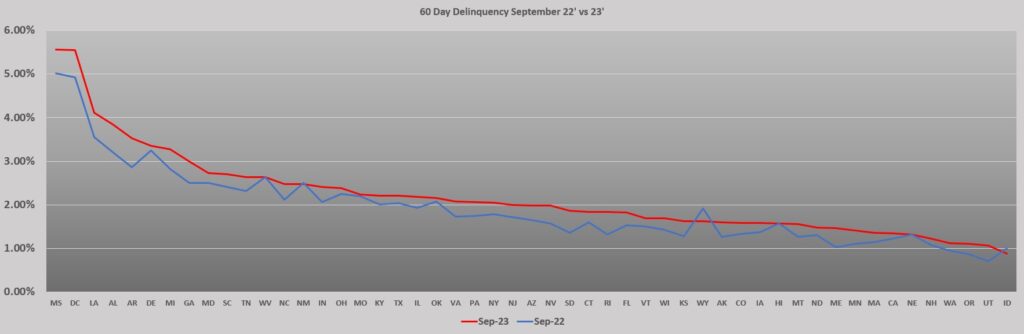

Top 5 States for Auto Loan Delinquency

- Mississippi

- District of Columbia

- Louisiana

- Alabama

- Arkansas

No real surprises here, they’re all concentrated in the south, where historically average FICO scores are some of the lowest in the nation. But there is the odd exception of the District of Columbia.

Despite by population having the highest of the top 5 in super prime FICO score concentration, they ended up at number 2. This is actually an improvement over August when their 30-day delinquency was 10.01% and 60-days were 5.83%. It must be their 21.9% subprime population to blame. This is over 6% the national average.

See or Download the Entire Chart Here!

Below is the full list of states with the highest auto loan delinquency for the end of the 3rd Quarter 2023 according to TransUnion.

Similar data is available in TransUnion’s report for bankcards and mortgages and unsecured loans.

More Credit Industry Snapshots can be found HERE

About TransUnion

(NYSE: TRU) TransUnion is a global information and insights company that makes trust possible in the modern economy. W – e do this by providing a comprehensive picture of each person so they can be reliably and safely represented in the marketplace. As a result, businesses and consumers can transact with confidence and achieve great things. We call this Information for Good®. A leading presence in more than 30 countries across five continents, TransUnion provides solutions that help create economic opportunity, great experiences and personal empowerment for hundreds of millions of people.

States with Highest for Auto Loan Delinquency in Q3 2023 – States with Highest for Auto Loan Delinquency in Q3 2023 – States with Highest for Auto Loan Delinquency in Q3 2023

States with Highest Auto Loan Delinquency in Q3 2023 – Delinquency – Credit Union Collections – Credit Union Collectors – TransUnion – TransUnion

More Stories

Husband and Wife Face Racketeering Charges in Luxury Vehicle Title Fraud

Fraud is Top-of-Mind for Nearly Nine-in-Ten Auto Dealers

🎯 Meet Your 2026 Summit Keynote Speaker: Jovan Glasglow