– On July 15, 2025, a federal judge struck down a Consumer Financial Protection...

Collections

October 22, 2025 – October 24, 2025 Silver Legacy Resort Reno, NV FOR IMMEDIATE RELEASE...

– The Darkest Day in Collections History On the morning of June 17, 1990,...

Strengthen Your Team’s Growth TriVerity Collection Academy | Bloomington, MN | September 22-24 Meet...

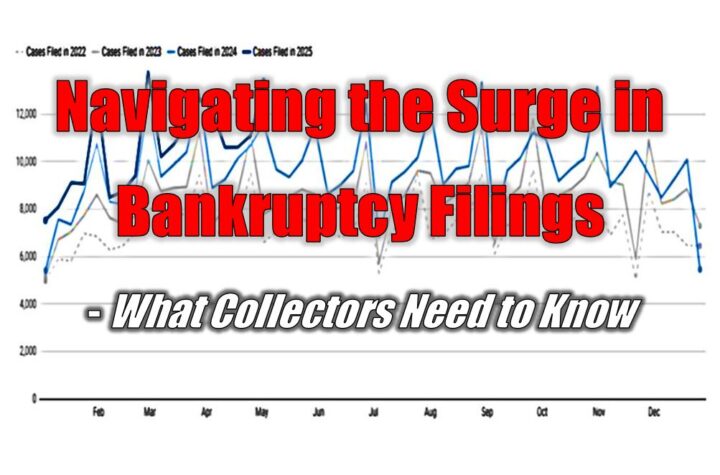

529,080 cases were filed in the 12 months ending March 31, 2025—a 13.1% jump...

Strengthen Your Team’s Growth TriVerity Collection Academy | Bloomington, MN | September 22-24 Empower...

October 18, 2025 – October 27, 2025 Silver Legacy Resort Reno, NV CCUCC 2025 Annual...

LITTLETON, Colorado—March 25, 2025—PassTime®, a leading provider of asset tracking solutions announced today that...

TriVerity’s Collection Academy Scholarship Program provides you with the opportunity to attend the unique...

October 18, 2025 – October 27, 2025 Silver Legacy Resort Reno, NV Registration Now Open...

On February 1st, CFPB Director Rohit Chopra was fired by the Trump administration. Taking...

As the economic landscape continues to shift—impacted by inflation, high interest rates, and the...

Hilton New Orleans Riverside New Orleans, LA May 14, 2025 – May 16, 2025 FOR...

It is with profound sadness and deep respect that we announce the passing of...

October 24-26th Renaissance Esmeralda Resort & Spa Indian Wells, California Time is running out...

🏅Go for Gold in Collections! The spirit of the Olympics is all about striving...

Building Effective Collections Teams The Roles of Training, Teamwork, and Empathy featuring TEG FCU...

AutoSquared.AI Prepares Industry for Exponential Growth AutoSquared.AI imagines a world where repossession management is...