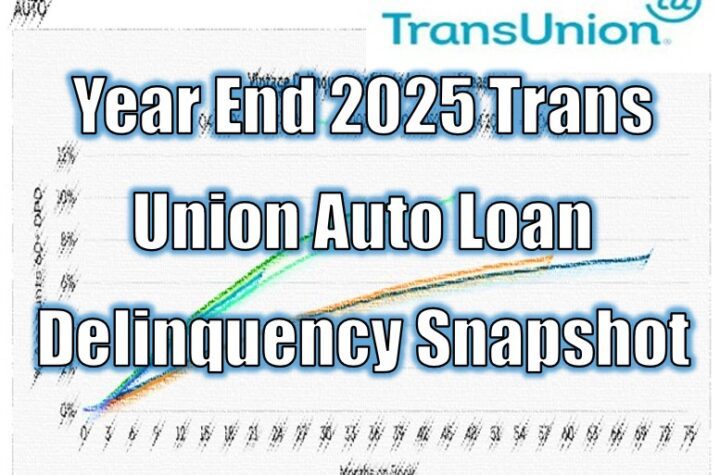

Consumer 30+DPD increased to 4.49% (17 bps); 60+DPD increased to 1.71% (11 bps) –...

Credit Reporting

$36 Million Redress Judgment: Credit Repair Giant and Owner Barred After Years of Deception...

For collectors and lenders, this ruling underscores the importance of maintaining clear loan documentation...

– On July 15, 2025, a federal judge struck down a Consumer Financial Protection...

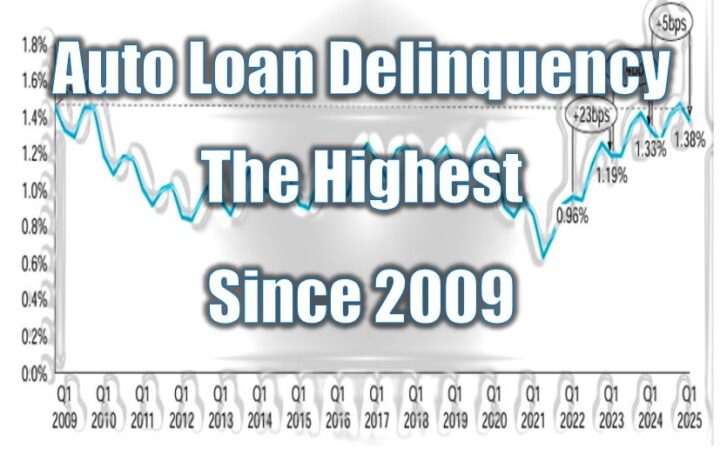

The 60+ DPD delinquency rate increased by 5 basis points YoY in Q1 2025...

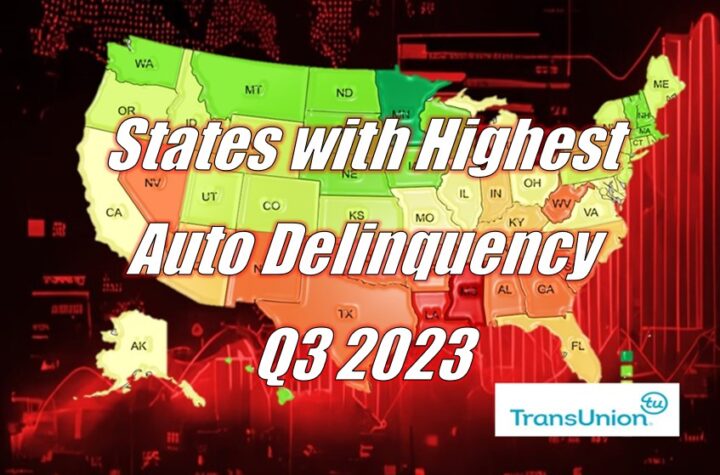

States with Highest Auto Loan Delinquency in Q3 2023 Earlier this month, TransUnion, one...

As Auto Loan-to-Value Ratios Rise and Used Vehicle Values Fall, More Consumers Find Themselves...

CFPB Orders Repeat Offender Portfolio Recovery Associates to Pay More Than $24 Million for...

“The report found the total number of collections tradelines on credit reports declined by...

PSCU’s TriVerity announces new indirect credit bureau dispute processing solution WYOMING, MN (September 14,...

Company Furnished Inaccurate Account Information to Credit Reporting Companies, Including Wrongly Reporting that Consumers...

“TransUnion is an out-of-control repeat offender that believes it is above the law,” said...

Equifax, Experian and TransUnion to begin changing how medical debt collections are reported Credit...

Equifax, Experian, and TransUnion routinely failed to fully respond to consumers with errors WASHINGTON,...

Washington, DC – SEP 23, 2021 – The Consumer Financial Protection Bureau (CFPB) today...

CUNA Warns Disruptive’ changes to FCRA could impact financial access In a statement issued...

NAFCU Vice President of Legislative Affairs Brad Thaler wrote to the House Financial Services Committee Monday...

Now Beyond Talk, A CFPB Run Credit Reporting System Inches Toward Reality Last week...