ffThe Gen Y – The Ticking Debt Timebomb

Earlier this month, the Federal reserve Bank of New Yor (NY Fed), released their 2nd Quarter Report on Household Debt and Credit. While credit card balances topping $1 trillion dollars stole the national headlines, the dire state of delinquency rising in auto loans and credit cards by the age group known as Gen Y is continuing perform far worse than others. With inflation back on the rise and student loan payments set to restart, this age group appears set to explode.

Generation Y, as it is called, is the demographic group between the ages of 25 to 40, which represents 72 million Americans, roughly 21.67% of the population. While the NY Fed breaks its generations down into two groups between 18-29 and 30-39, the bulk of Gen Y sits in both categories.

The NY Fed uses Equifax credit reporting data to develop these statistics. One subdivision that they could create that many of us would find interesting would-be statistics on repossessed vehicles by quarter. I expect that with a twenty-year look back, we would see some interesting developments as we roll into the fourth quarter.

Download the Full Report Here!

Total Debts

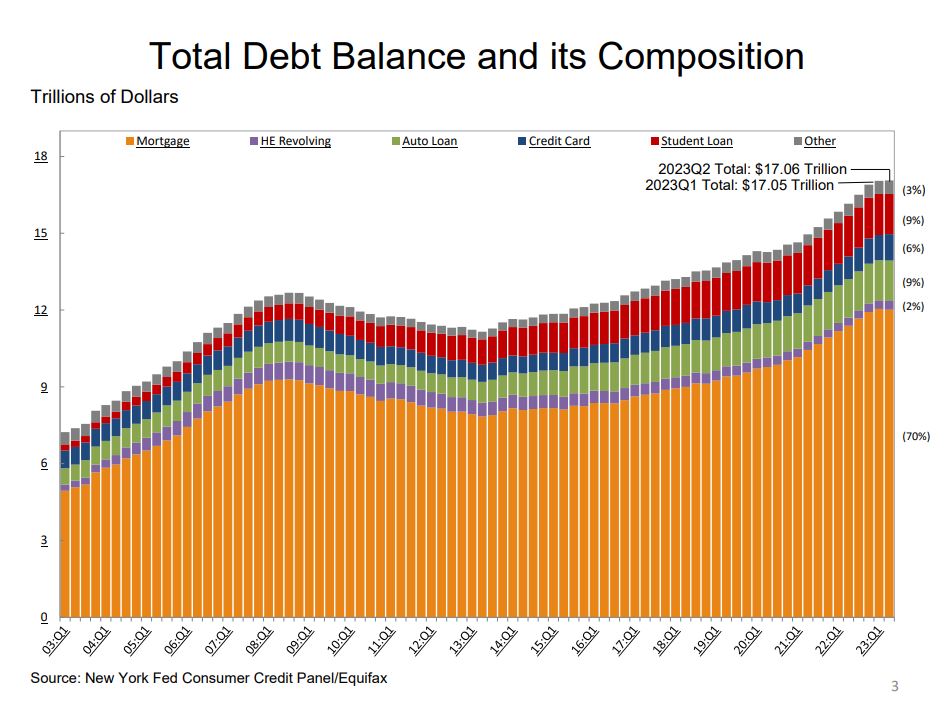

Before digging into the generational debt and delinquency data, let’s take a quick look at the overall debt wracked up over the last quarter.

Credit card balances increased by $45 billion. That’s a 4.6% quarterly increase, and now stands at $1.03 trillion. Auto loan balances increased by $20 billion. This is a continuation of the upward trajectory that has been in place since 2011. Other balances, which include retail cards and other consumer loans, increased by $15 billion.

Student loans balances, which have been on pause since the pandemic, declined in balance by $35 billion and now stand at a whopping $1.57 trillion. While credit card balances stole all the economic headlines, it’s actually tame compared to this ticking timebomb waiting to blow. With payments expected to resume in October. I suspect that it won’t be until late in the 4th quarter that we feel this.

Delinquency

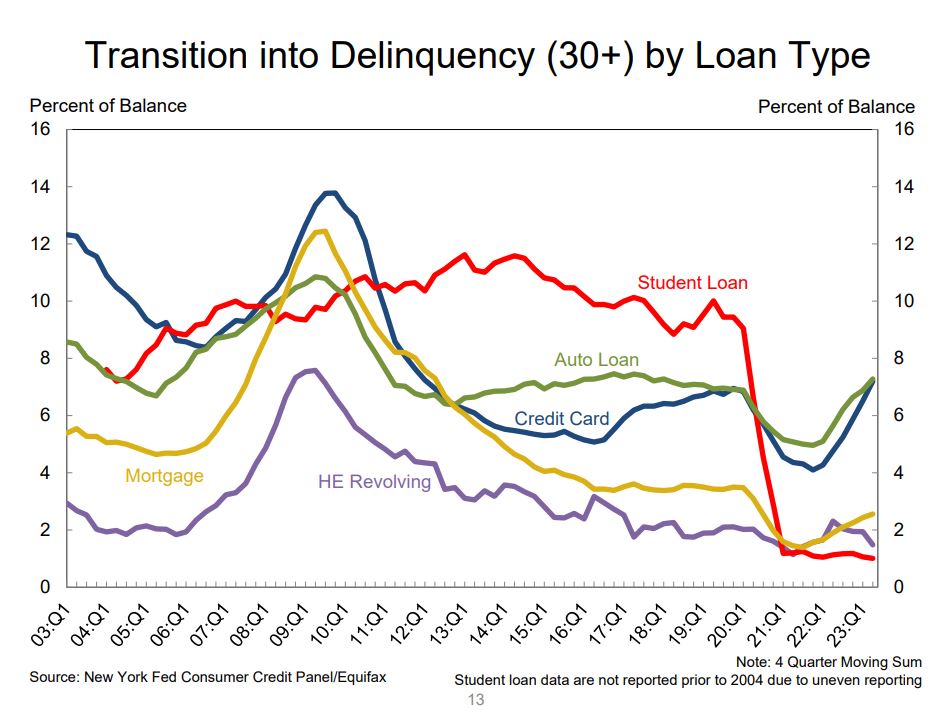

Q2 23 actually did fairly well and held steady to the prior quarter when instead of showing some relief from Q4 22, it remained flat. This bucked traditional delinquency trends for the worse. Unfortunately, pre-pandemic, Q3 had historically shown some of the sharpest increases in delinquency, so, we’re not our of the woods by any means.

Transitioning in 30 days delinquent debt for credit cards and auto loans are now above pre-pandemic levels and beginning to resemble those in the three years following the 2008 Great Recession. Real estate is trending upward moderately and student loans are obviously flat, where they’ll likely remain until the fourth quarter. After then, who knows?

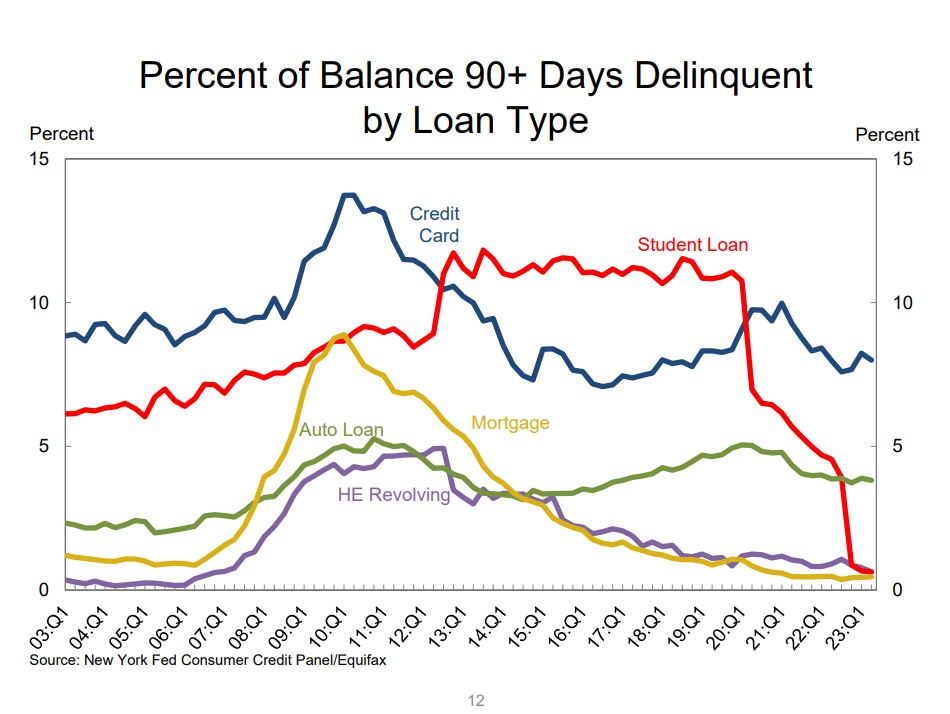

Loans transitioning into 90+ days delinquent are just about at pre-pandemic numbers but rising steadily by the quarter. This is the collections “Land of the Lost” where repossessions, foreclosures and charge off losses happen. Expect to see these worsen in Q3 if traditional seasonal delinquency trends persist.

Debt and Delinquency by Age

If we look at Debt Share by Product Type and Age, you can see why I am so pessimistic about the student loan payment resumptions. Gen’s Y through millennials carry more of this than anyone other age group. This additional debt burden on top of persistent inflation endangers all loan product performances in the future. The share of debt newly transitioning into delinquency increased for credit cards and auto loans, with increases in transition rates of 0.7 and 0.4 percentage points respectively.

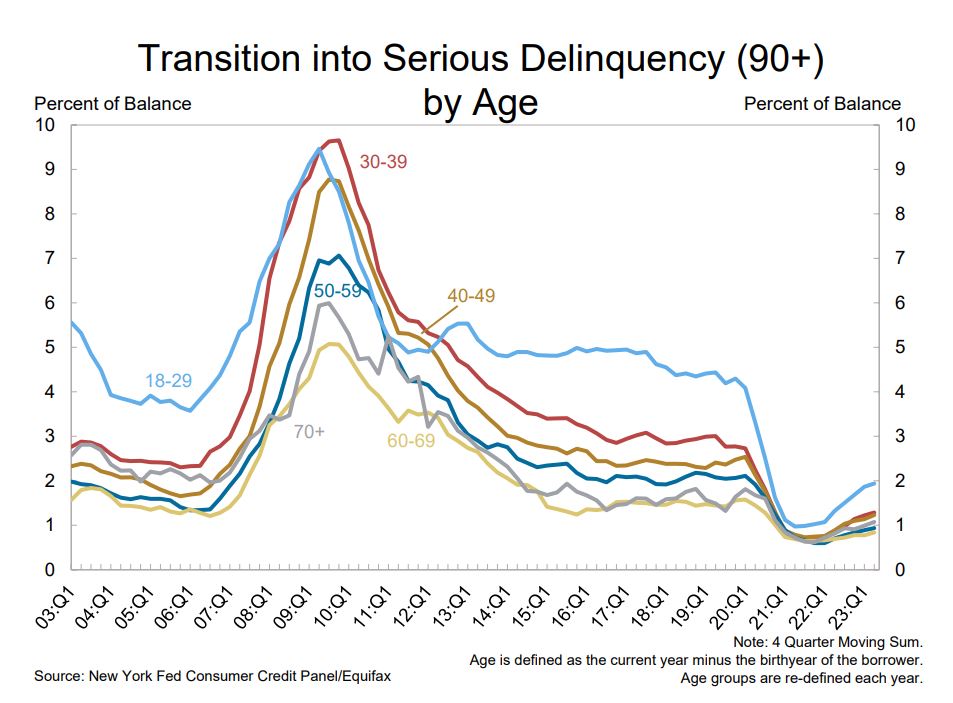

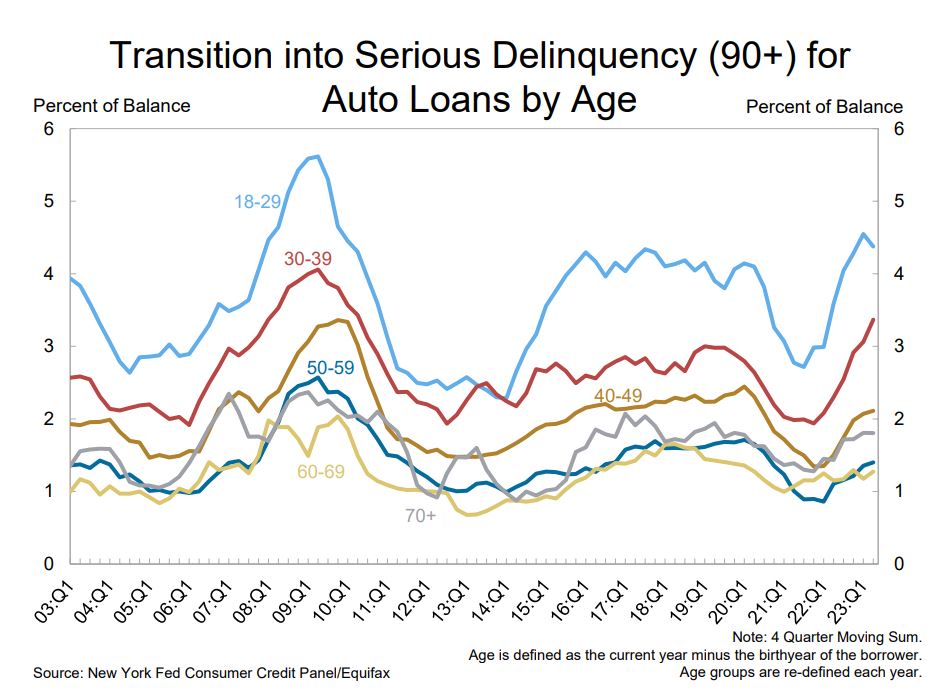

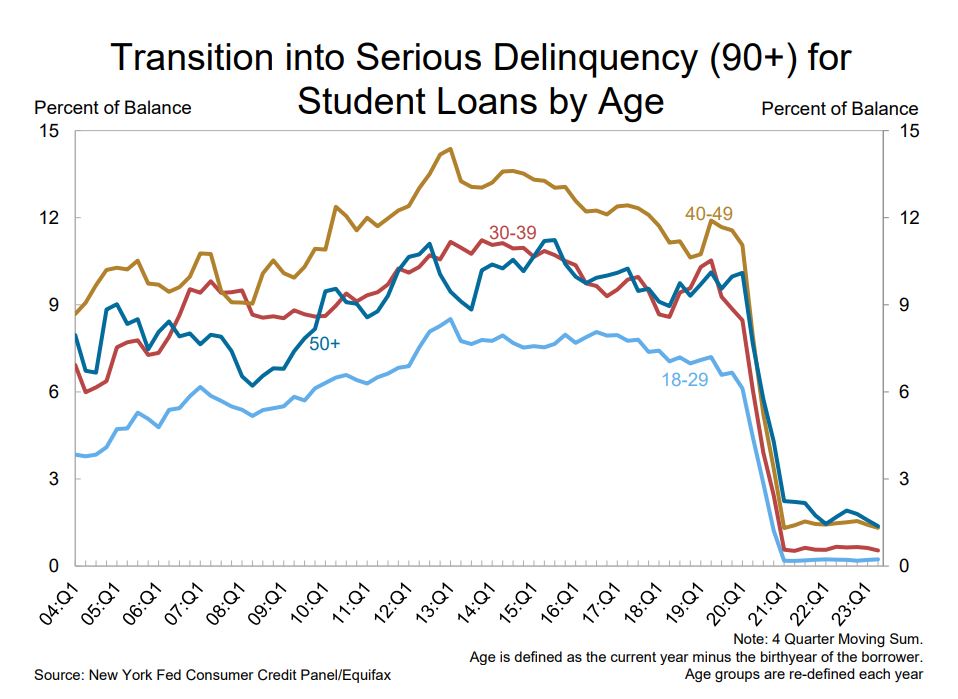

Looking at auto loans transitioning into Serious Delinquency (90+) by age group, almost all age groups showed increases. The oddity being the 18–29-year-old age group who defied all odds and actually showed a reduction. Ages 30-39 creeped up into the area of 2011 on the tail of the Great Recession. Again, if this trend continues in Q3 23, we’ll be looking at default levels not seen since the late 2000’s.

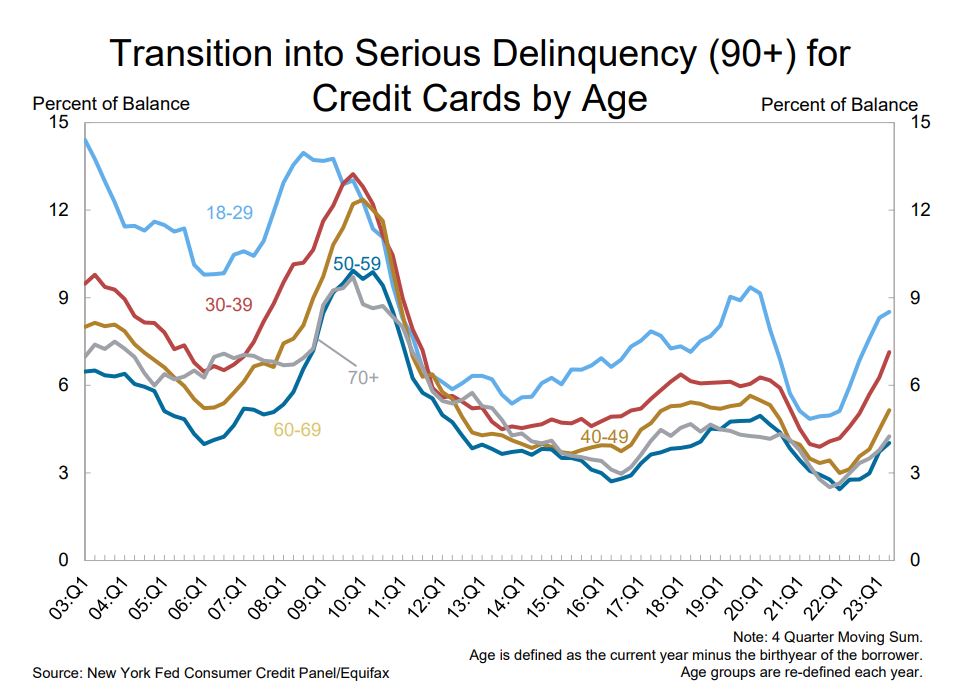

Once again, we see the 18–29-year-old age group still below pre-pandemic numbers with credit cards transitioning into Serious Delinquency (90+) by age group. And again, we see the 30-39 age group well above pre-pandemic levels. Keep in mind, inflation is merely an external factor in this as the numbers are based on percentages and not balances. According to the NY Fed, Credit cards balances saw the most pronounced worsening in performance in 2023 Q2.

Foreclosures, Bankruptcies and Third-Party Collections

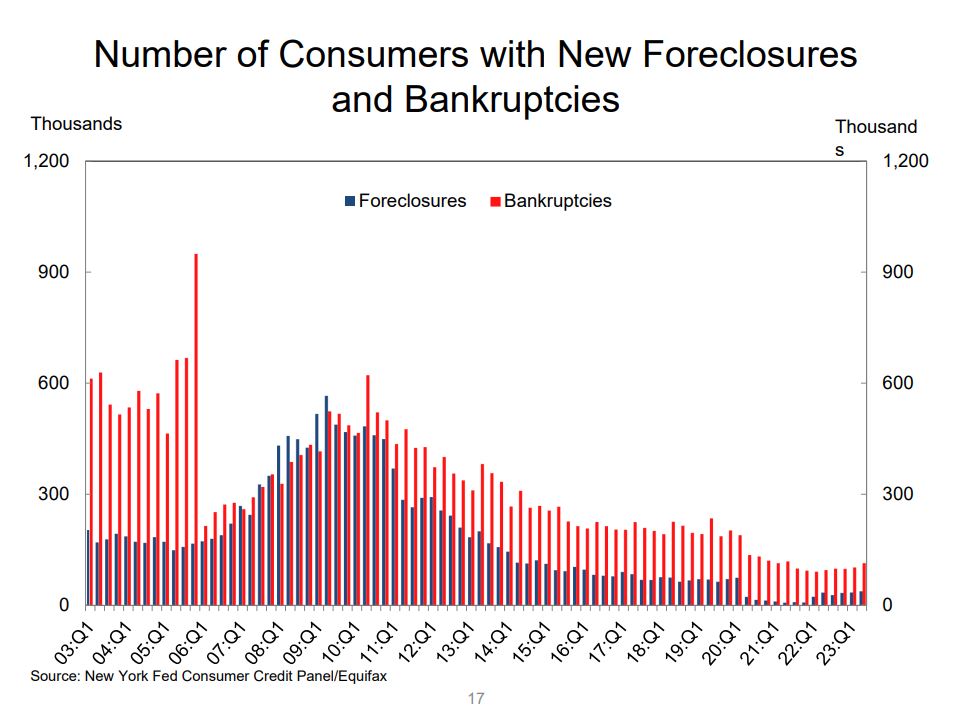

When you look at these numbers, you can see that foreclosures and bankruptcies are still very low. While still on the rise, they have yet to have any major impact on delinquency. But that too could change too.

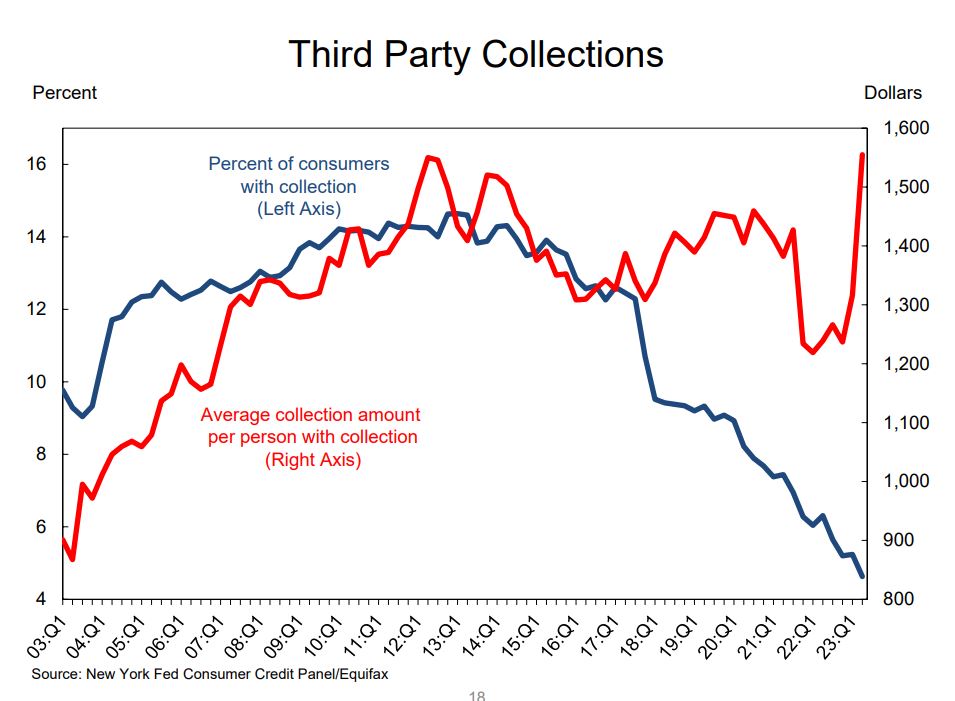

Approximately 4.6% of consumers have a 3rd party collection account on their credit report, with an average balance of $1,555, up from $1,316 in the first quarter, reflecting composition changes in 3rd party collections amid new credit reporting regulations.

Of curious mention are the third-party collections account data. While the percentage of consumers with collections accounts has plummeted to the lowest level in at least twenty-years, the average amount owed are the highest ever.

The Gen Y Timebomb

There is a cycle in the development of credit that starts young. Persons with little credit tend to carry smaller balances in general. As they age and their credit record matures, the debt balances tend to increase. Often, student loans are the first and largest loan balances they carry.

The problem that Gen Y experienced, that most older generations did not have to deal with, was the pandemic and the three year suspension of student loan payments. They got too used to it and then were cruelly promised by the current presidential administration that these loans would be forgiven.

I fear that human nature will prevail. I believe that many of these people have already dedicated the portions of their income that were going to making student loan payments, to new debts. Worse, those who have never had to pay may have no capacity to do so and this will create additional financial stress on a population already struggling with persistent inflation.

As far as how prepared lenders are for this, I doubt anyone really is. This is another one of those unique out of the box experiences, like the Great Recession and the pandemic, that collections departments face every decade or two. One thing that concerns me is how lenders have been calculating borrower debts since the pandemic. I wonder how many out there did not properly account for the resumption of these debts into the debt-to-income ratio calculations on loans funded over the past three years.

Time will tell, but if delinquency trends worsen and this has the effect on Gen Y that I fear it will, we will see an explosion of delinquency by the end of the year. And Gen Y will be hit the hardest.

Kevin Armstrong

Publisher

Related Article;

Gen Y Leading in Delinquency, And It’s About to Get Worse

The Gen Y Debt Timebomb – The Gen Y Debt Timebomb – The Gen Y Debt Timebomb – The Gen Y Debt Timebomb – The Gen Y Debt Timebomb – The Gen Y Debt Timebomb

More Stories

Former CU Loan Officer Sentenced for Million-Dollar HELOC Scheme

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions