As delinquency in auto loans and credit cards begins its climb, there is one generation leading the way. Generation Y, the demographic group between the ages of 25 to 40, which represents 72 million Americans, roughly 21.67% of the population. While inflation and lower wages are mostly to blame for their issues with debt, they are sitting on a ticking timebomb that may soon make things far worse.

When the pandemic struck in 2020, the median net worth for millennials was $40,100, which is far below Gen X $149,100 and $262,900 for baby boomers. Of course, preceding generations have had more time to build that wealth, but factors such as debt and income also play a major role.

Worse yet, lower-income millennials tend to pay a disproportionately higher share of their incomes on living expenses. According to a Government Accountability Office study, these lower earning millennials carried student loan debt almost four times more than their incomes in 2016, considerably higher than their highest-earning millennials counterparts whose student loan debt load was equal to about one-third of their income.

The pandemic, inflation and rising interest rates are making things harder for them than just about any other generation and the data is pretty clear.

Credit Cards

According to the April quarterly report on household debt released by the Federal Reserve Bank of New York, despite consumer debt topping a record $17T in the first quarter, credit card balances were flat, at $986 billion. While this may sound good, it actually bucks the typical trend of balance declines in first quarters. While not massive, Gen Y carries an average credit card balance of just over $4K.

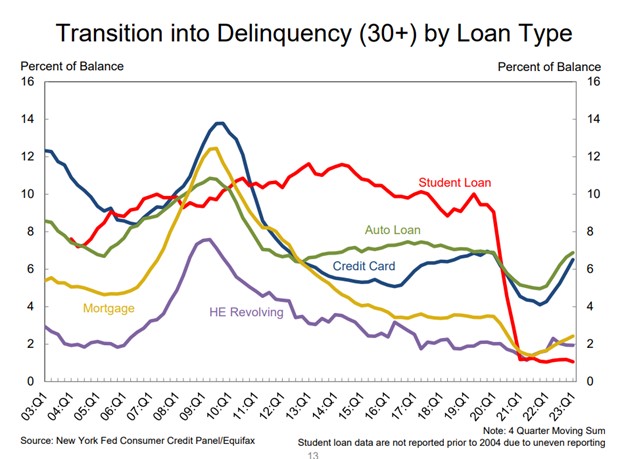

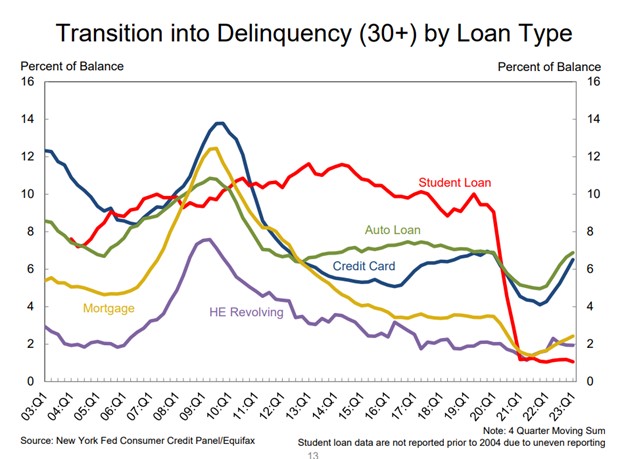

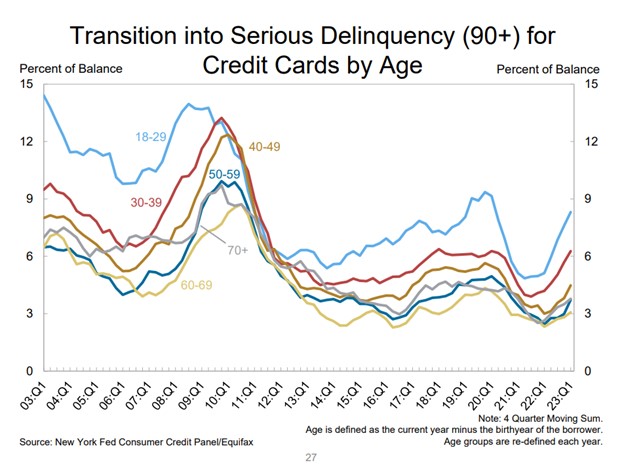

The report shows credit card delinquencies are edging up at a rate of .02 percent, just as they did last year. Gen Y, shown in the NY Fed’s charts, shows them contributing to it at a substantially higher rate than any other generation.

While all age groups delinquencies dropped during the pandemic, most generations remain well below their pre-pandemic credit card delinquency levels. That is, except Gen Y who have already nearly resumed their pre-pandemic delinquency levels.

And this is where they are struggling the least.

Autos

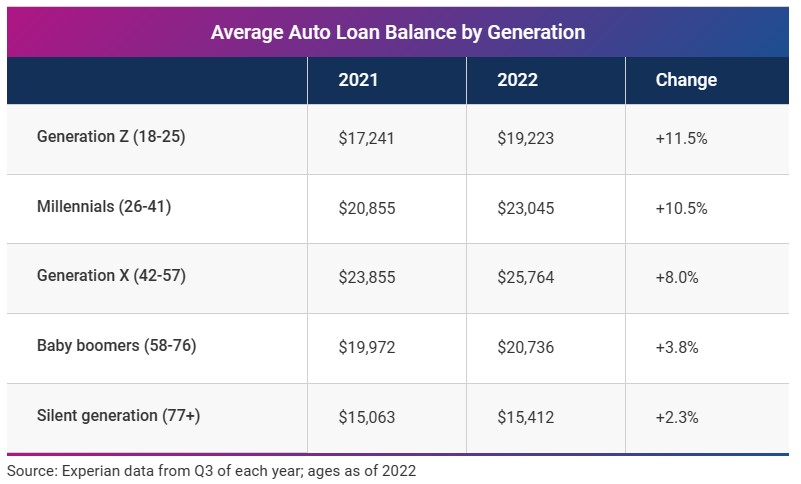

According to Experian, Consumers owed a total of $1.41 trillion on the vehicles they drove in 2022, an increase of $72 billion over the previous 12 months. The average auto loan balance rose 7.7% to $22,612. Auto loan balances increased by $10 billion in the first quarter, a continuation of its upward trajectory that has been in place since 2011.

But for Gen Y, these loan balances have climbed from $20,855 in 2021 to $23,045 at the end of 2022. That is a 10.5% increase. And for those who’ve made purchases over the past six months, they’re suffering higher interest rates than they did in 2021.

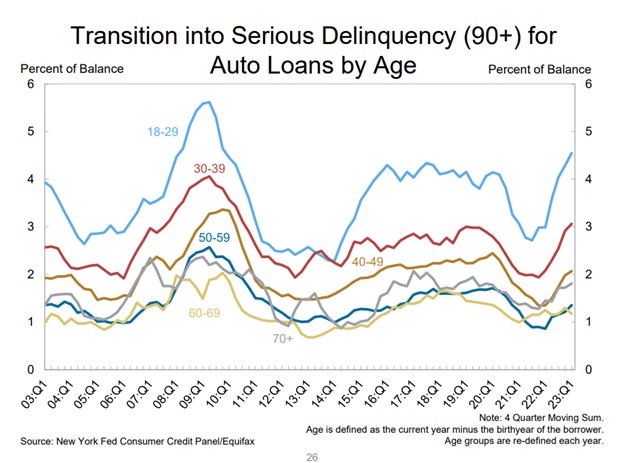

Overall, transition rates into serious delinquency (90 days +) for auto loans have increased and almost recovered to pre-pandemic levels at 2%. But for Gen Y, they have already gone past that and finished Q12023 at 4.6% for the 18-29 age group and up to about 3.1% for those 30-39 years of age.

These rates far exceed pre-pandemic levels and have not been seen since the year following the Great Recession.

The Time Bomb

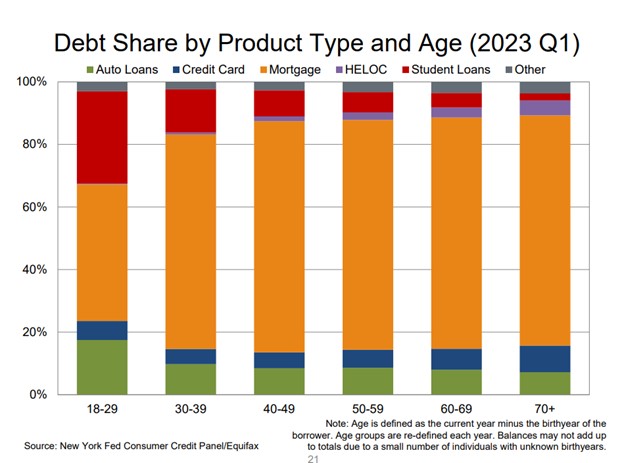

There is one loan type that Gen Y holds a higher percentage of than any other age group; student loans. There is a total of $1.6T in outstanding student loans and the average loan balance carried is $33K. Almost twenty-five percent of all the debt carried by Gen Y are student loans.

The problem with this is, no one is paying them.

As a response to the pandemic in March of 2020, federal student loan repayments have been paused for millions of eligible borrowers. This postponement of monthly payments and accruing interest have now been extended eight times by the Biden Administration, and most recently through June 30, 2023.

Whether or not they can maintain this pause is yet to be seen and the probability of outright waivers of these debts is unlikely. At some point, these bills will resume, and these debt payments probably weren’t counted into the debt ratios as they should have been during loan originations made during their pause.

If, or when they recommence, there is a strong likelihood that the extra financial pressure caused by these will ripple across delinquency rates for all loan products, but Gen Y may very well suffer the worst. It’s not that the age groups under forty don’t have a long track history of experiencing delinquency more than other generations, it’s the possible student loan recommencement that really adds a unique wrinkle to the issue.

It’s going to be an interesting summer in delinquency, that’s for sure.

Kevin

Gen Y Leading in Delinquency, And It’s About to Get Worse – Delinquency – Credit Union Collections – Credit Union Collectors

Facebook Comments