According to Black Book’s June 6 Market Insights report, the wholesale auction market may be in for a rough summer. Pre-pandemic seasonal trends have yet to return and we are experiencing wholesale declines not last seen since 2009, at the end of the Great Recession.

Market Insights – 6/6/2023

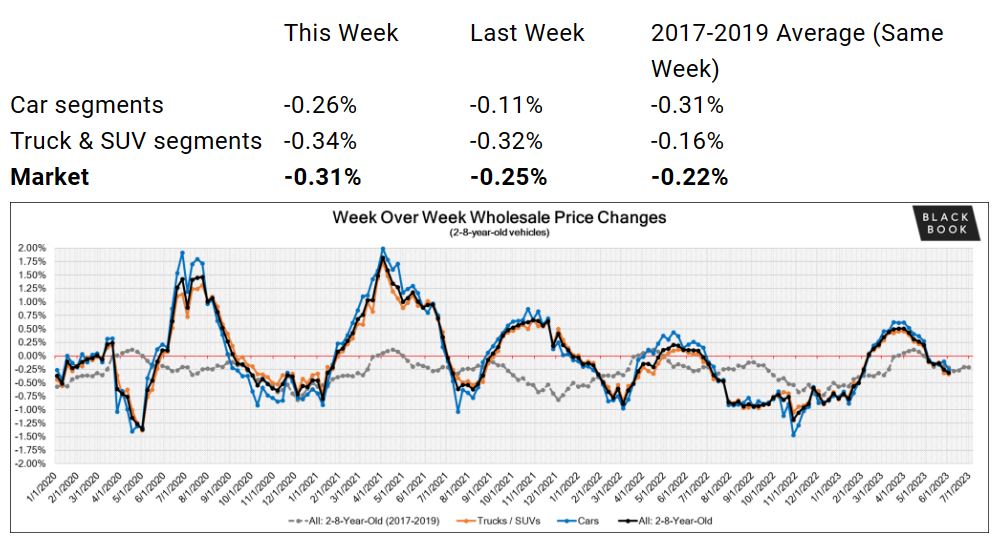

Wholesale Prices, Week Ending June 3rd

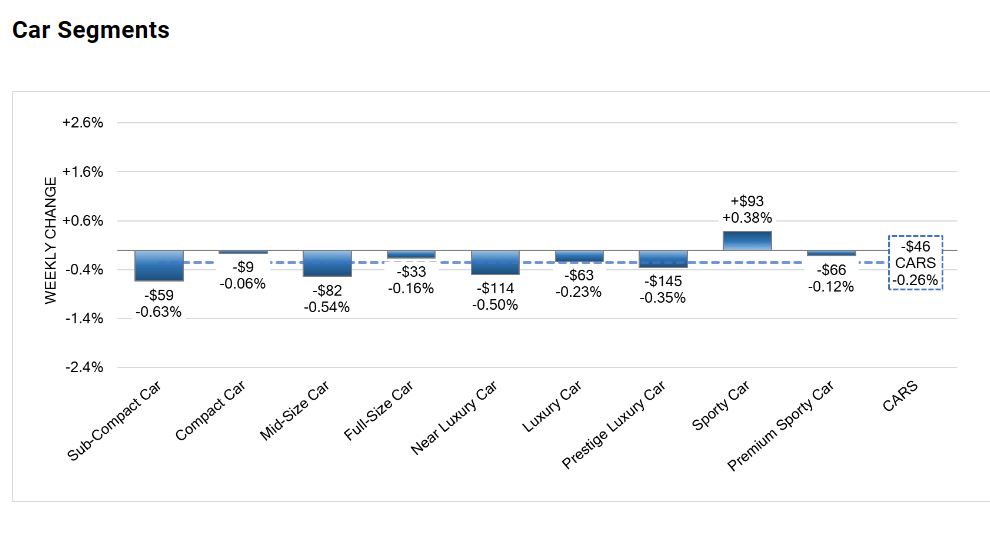

The market continued to decline last week, down -0.31%. The level of depreciation exceeded pre-COVID norms for this time of year of -0.22%. Sporty Car (+0.38%) and Full-Size Trucks (+0.06%) were the only segments to increase last week.

- On a volume-weighted basis, the overall Car segment decreased -0.26%. For reference, the previous week, cars decreased by -0.11%.

- Sporty Car was the only segment to increase last week, up +0.38%. The week prior, the segment declined -0.19%.

- Sub-Compact Car had the largest decline last week, down -0.63%. This is the fifth consecutive week of declines for the segment for an average weekly decline of -0.39%.

- The volume-weighted, overall Truck segment decreased -0.34%, compared with the prior week’s decrease of -0.32%.

- Only one of the thirteen Truck segments reported an increase last week.

- Full-Size Trucks increased +0.06%, after the previous week’s decline of -0.24%.

- Compact Luxury (-0.67%), Sub-Compact Luxury (-0.62%), and Mid-Size (-0.62%) Crossovers reported the largest declines last week.

Weekly Wholesale Index

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last three years.

We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for most of the year.

The Wholesale Weekly Price Index reached the highest point of the year at the end of December 2021, reporting over 1.51 points. In 2022, the price index was on a mild rollercoaster until July, after which point, prices were on a continuous decline until the end of the year.

Wholesale

June has started off on a positive note, with auction conversion rates increasing for the first time in four weeks. We saw more buyers in the lanes and online last week than in weeks in the prior months. Prices are still moving in both directions, while 1500 series trucks rebounded this week after last week’s dip, other segments continue to see prices following a downward trend. As always, the Black Book team of Analyst will keep their eyes on the market watching for developing trends and insights.

The Estimated Average Weekly Sales Rate increased to 49% last week.

Wholesale Auction Value Dive Deepens – Credit Union Collections – Remarketing – Wholesale – Black Book

More Stories

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions