The Worst is Yet to Come Back in March, I predicted the usual seasonal...

Charge Off

The Storm Has Arrived Last year, I warned you that we were experiencing “The...

“… we’ve been moving back the timing of repossession.” In a high-stakes game of...

Coming off of the much needed 1st quarter 2024 delinquency reduction in auto loans,...

From $269M to $724M – Charge Off More than Doubled in 2023 If you...

On October 19th, Ally Financial held its third quarter 2022 earnings conference call for...

Part 1: How Deep Skip Repossession Services Locates the Most Elusive Vehicles When an...

There are two models of online debt trading. Let’s call the first one the...

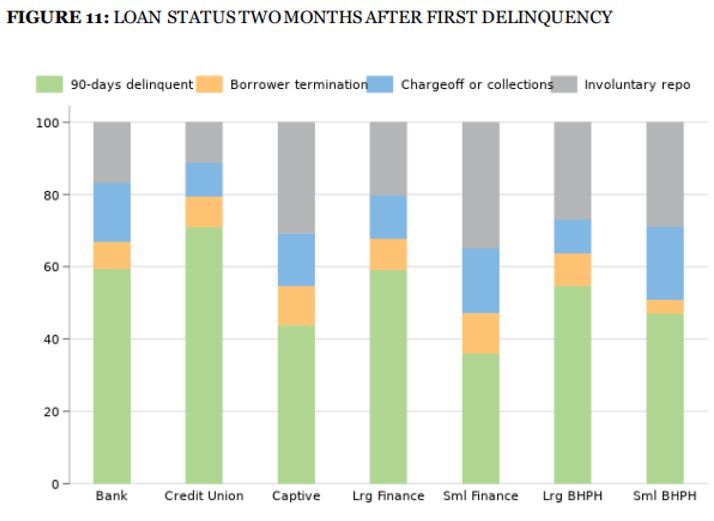

Almost unnoticed last month, the Consumer Financial Protection Bureau released a Data Point report...

Trading on the Platform Is Now Available on Any Mobile Device PRESS RELEASE July...

Like many credit unions nationwide, you probably have a considerable amount of charged off...

Fraud for Profit and Fraud for Car Are Two Different Things It’s an open...

Available industry data is clear, if a repossession agent has not recovered a vehicle within 30...

PRESS RELEASE More than 300 enterprise lenders nationwide are using DRN’s Historical Data to...

From the NAFCU Compliance Blog The compliance team has heard from several members lately...

Today, Experian and Oliver Wyman launched the Ascend Portfolio Loss ForecasterTM, a solution built to...