Early Bird Pricing Ends 8-31-19!

FOR IMMEDIATE RELEASE

Orlando, FL – 21 August 2019 – After a very successful first year inaugural event in 2019, the Credit Union Collections Professionals (CUCP) will be holding it’s second annual CUCP Summit on October 9-11th, 2019, at the headquarters of Civic Federal Credit Union in Raleigh, NC. 2019 promises to be even bigger with a great line up of industry expert speakers scheduled.

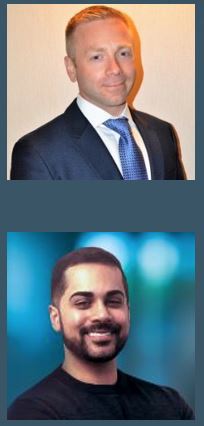

BILL PARTIN – President and Chief Executive Officer, Sharonview Federal Credit Union

Bill joined Sharonview in September of 2013 and has a passion for developing leaders, driving results and creating an energizing work climate. Since joining Sharonview, Bill has led the company to earning the distinction of being named South Carolina’s Best Credit Union by Forbes in 2018.Prior to joining Sharonview, Bill was the Senior Vice President, Chief Member Services Officer for Partners Federal Credit Union (the Walt Disney Company credit union).He has more than 38 years of experience in the financial services industry and he also spent three years with Dean Witter and four years as President of Duerr Financial Corporation, a regional broker-dealer.

DAVID REED – Attorney , Reed and Jolly

David A. Reed is a partner in the law firm of Reed and Jolly, PLLC. David provides guidance to credit unions concerning a variety of matters including the establishment and revision of policies and procedures, organizational compliance, collections, security, contractual agreements, regulatory matters and corporate governance. Mr. Reed is a Certified Fraud Examiner and Chairman of a Supervisory Committee. His engaging speaking style has garnered him status as a regular lecturer nationwide on topics such as regulatory compliance, governance, examination planning, consumer lending, bankruptcy and collections.

JIM SORENSON – Attorney , Sorenson Van Leuven

Jim is a member of the American Bankruptcy Institute and is past President of the Northern District Bankruptcy Bar Association. Jim is admitted to practice before the Federal Courts in the Northern, Middle and Southern Districts of Florida and Georgia and the Eleventh Circuit Court of Appeals. He regularly conducts seminars and workshops on collections, bankruptcy and consumer protection issues. In addition to representing clients in state and federal court, Jim also has developed an expertise advising Credit Union clients on how to effectively manage and operate a successful collections department.

CHRIS MCNAMARA – Director, TransUnion First Party Collections Market Strategy

Chris McNamara has been with TransUnion since 2017 and is Director of Market Strategy, First Party Collections, within the Financial Services division. Chris is responsible for identifying and developing new products and services to support lender’s collection efforts. Chris has over 15 years of experience within financial services, leading various aspects of collections and operations. In his past roles, Chris has led both collections and lending operations teams at both BCU and Alliant Credit Union. Chris holds a B.A. in Psychology, and an MBA, both from DePaul University in Chicago.

Zohaib (ZO) Rahim – Manager of Economics & Industry Insights, Cox Automotive

His primary focus is to create meaningful insights using data from all of the company’s businesses and platforms and relate to economic, industry and demographic trends. Prior to joining Cox Automotive, Zo worked at Porsche (both the OEM and the captive finance arm) doing market intelligence, competitive research, sales strategy, and vehicle planning/incentive development. Zo holds a bachelor’s degree in economics and mathematics from Emory University.

For Registration, hotel information, and pricing visit www.CUCPros.org

Hurry, space is limited!

About the CUCP:

The mission of CUCP is to develop, educate, promote and provide a professional support system to all people in the Credit Union movement; by providing training, networking opportunities, and promoting the professional growth of credit union team members.

The CUCP contributes to the success of its members and the positive reputation of the collection industry through education, advocacy and services.

Our goal is to form a successful association that has a reputation for housing and developing some of the best practices for the Credit Union industry.