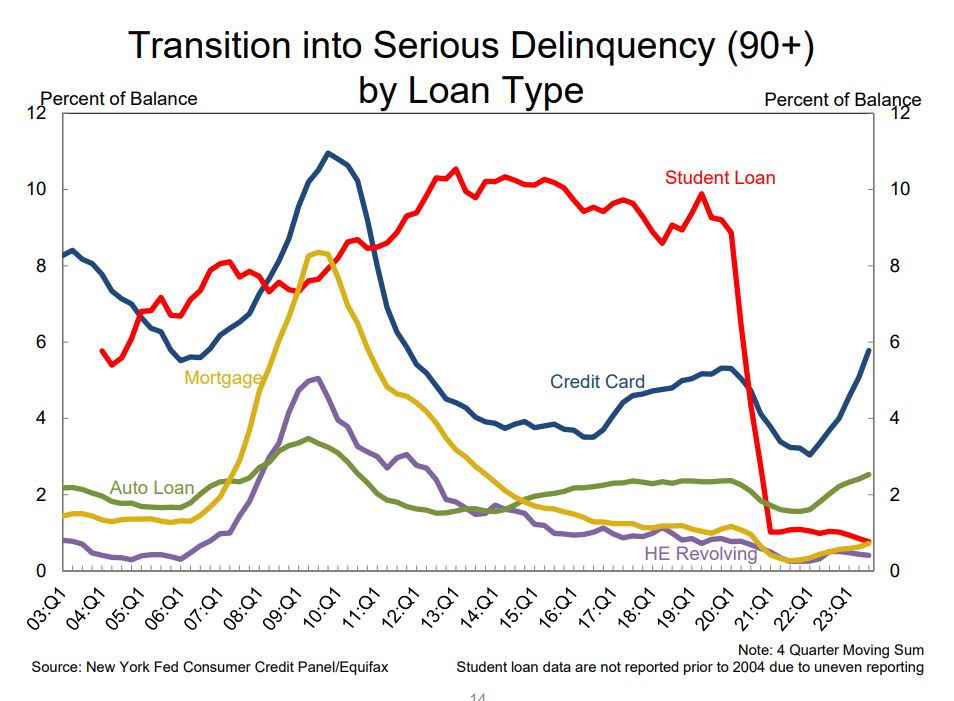

Delinquency transition rates increase for most debt types

PRESS RELEASE

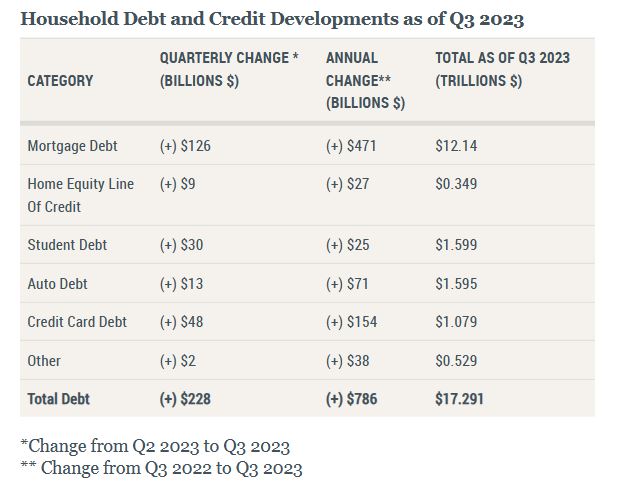

New York, NY – November 07, 2023 – The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows total household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Download the Entire Report Here!

Mortgage balances rose by $126 billion from the previous quarter and stood at $12.14 trillion at the end of September. Credit card balances increased by $48 billion to $1.08 trillion in Q3 2023, representing a 4.7% quarterly increase. Auto loan balances rose by $13 billion, consistent with the upward trajectory seen since 2011, and now stand at $1.6 trillion. Student loan balances increased by $30 billion and now stand at $1.6 trillion. Other balances, which include retail cards and other consumer loans, increased by $2 billion.

Mortgage originations modestly declined to $386 billion in Q3 2023 and are well below the robust quarterly origination volumes observed between 2020 and 2021. The volume of newly originated auto loans, which includes leases, slightly increased and now stands at $179.3 billion. Aggregate limits on credit card accounts increased by $113 billion, a 2.46% increase from the previous quarter.

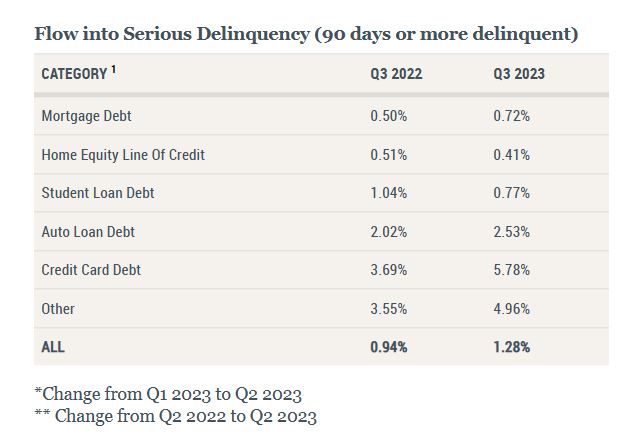

Aggregate delinquency rates increased in Q3 2023, with 3% of outstanding debt in some stage of delinquency at the end of September. Delinquency transition rates increased for most debt types except student loans and home equity lines of credit. The increases in credit card delinquency were the sharpest among borrowers between the ages of 30 and 39.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The continued rise in credit card delinquency rates is broad based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans.”

The New York Fed also issued an accompanying Liberty Street Economics blog post examining the composition of newly delinquent credit card borrowers. The Quarterly Report includes a summary of key takeaways and their supporting data points. Overarching trends from the report’s summary include:

Housing Debt

- There was $386 billion in newly originated mortgage debt in Q3 2023.

- About 36,000 individuals had new foreclosure notations on their credit reports, representing a small decline. The number of new foreclosures has remained very low since the CARES Act moratorium was lifted.

Student Loans

- Outstanding student loan debt increased by $30 billion and stood at $1.6 trillion in Q3 2023.

- Missed federal student loan payments will not be reported to credit bureaus until Q4 2024. Because of this policy, less than 1% of aggregate student debt was reported 90+ days delinquent or in default in Q3 2023 and will remain low until at least Q4 2024.

Household Debt and Credit Developments as of Q3 2023

About the Report

The Federal Reserve Bank of New York’s Household Debt and Credit Report provides unique data and insight into the credit conditions and activity of U.S. consumers. Based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data, the report provides a quarterly snapshot of household trends in borrowing and indebtedness, including data about mortgages, student loans, credit cards, auto loans and delinquencies.

The report aims to help community groups, small businesses, state and local governments and the public to better understand, monitor, and respond to trends in borrowing and indebtedness at the household level. Sections of the report are presented as interactive graphs on the New York Fed’s Household Debt and Credit Report web page and the full report is available for download.

1 Rates represent annualized shares of balances transitioning into delinquency. Flow into serious delinquency is computed as the balances that have newly become at least 90 days late in the reference quarter divided by the balances that were current of less than 90 days past due in the previous quarter.

Source: New York Fed

Consumer Debt and Delinquency on the Climb – NY Fed – Consumer Debt and Delinquency on the Climb – NY Fed – Consumer Debt and Delinquency on the Climb – NY Fed – Consumer Debt and Delinquency on the Climb – NY Fed –

Consumer Debt and Delinquency on the Climb – NY Fed – Delinquency – Credit Union Collections – Credit Union Collectors –

More Stories

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk