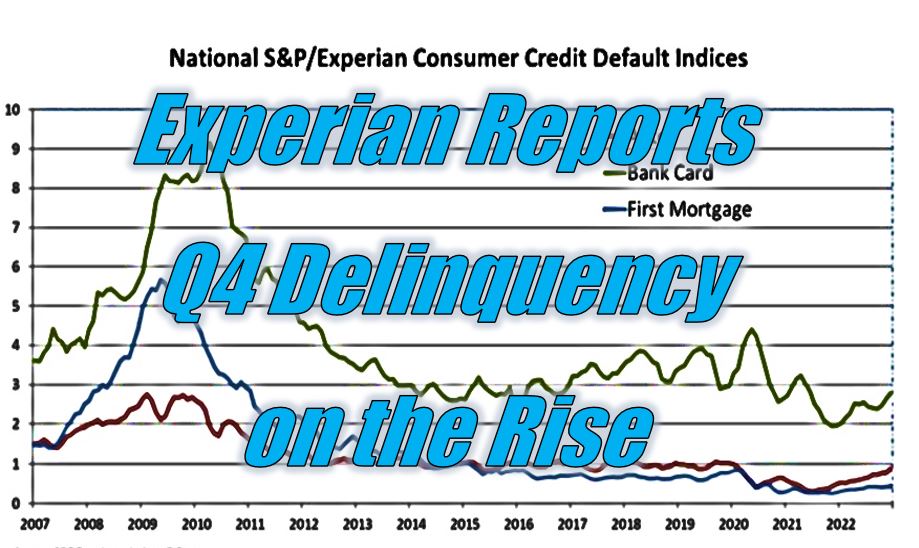

S&P/Experian Consumer Credit Default Indices Show Higher Composite Rate For December 2022 – Auto loan default rate at its highest since February 2020

NEW YORK, JANUARY 17, 2023: S&P Dow Jones Indices and Experian released today data through December 2022 for the S&P/Experian Consumer Credit Default Indices. The indices represent a comprehensive measure of changes in consumer credit defaults and show that the composite rate was four basis points higher at 0.63%. The bank card default rate was 15 basis points higher at 2.77% while the auto loan default rate was up 10 basis points to 0.87%. The first mortgage default rate increased one basis point to 0.43%.

Experian Reports December 22’ Auto Loan Default Rate at its Highest Since February 2020 – Experian – Credit Union Collections – Credit Union Collectors

More Stories

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions