New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers

“We see this in rising early delinquencies in auto and credit card debt”

PRESS RELEASE

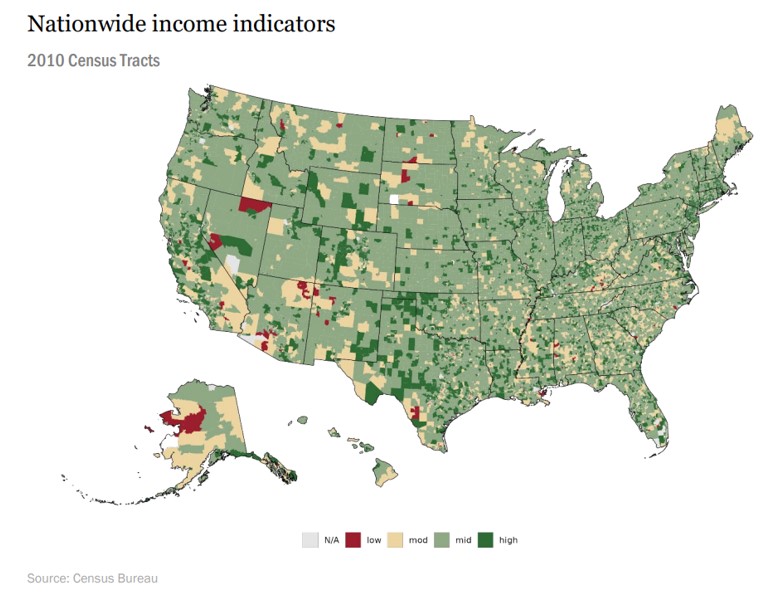

New York, NY – January 18, 2024 – The Federal Reserve Bank of New York today released “The State of Low-Income America: Credit Access & Housing,” a report examining debt holdings across income groups. As part of a series, this report offers insight into low-income households’ finances by examining their ability to obtain access to and maintain credit, as well as highlighting rental burden and the muted refinance boom in lower-income areas.

Download the Report Here

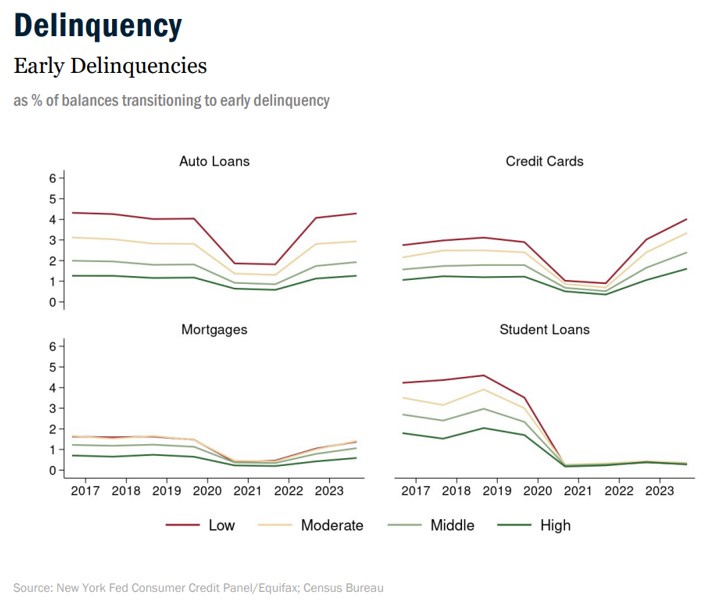

The 2024 report finds that early delinquencies on auto and credit card products began rising for low-income borrowers in 2022 through Q3 2023, exceeding pre-pandemic levels. It also reveals that homeowners in low-income neighborhoods were less likely than homeowners in wealthier neighborhoods to refinance their mortgages when interest rates were low in 2020 and 2021.

“Low- and moderate-income debt holders are struggling in today’s post-pandemic period,” the authors said. “We see this in rising early delinquencies in auto and credit card debt. Most low-income homeowners did not refinance during the mortgage refinancing boom, missing an opportunity to lower monthly mortgage payments.”

Among the report’s key findings:

- Only 24% of mortgages in low-income areas were refinanced between 2020 and 2021, compared to 42% of mortgages in high-income areas.

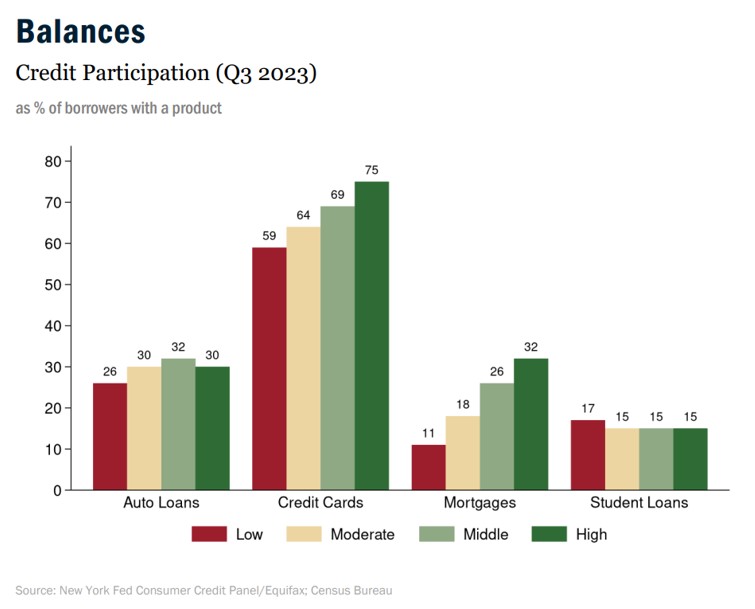

- Only 59% of people in low-income neighborhoods have credit cards. Median credit card balances are now higher for all groups than they were before the pandemic.

- In low-income areas, 57% of households are rent burdened, compared to 44% of households in high-income areas. Households are defined as “rent burdened” if they pay more than 30% of their monthly income on rent.

- Student loan delinquencies remain low due to the repayment moratorium. When payments resume, many borrowers may benefit from expanded income-driven repayment programs, but uncertainty regarding the availability and roll-out of the programs remains. Past-due student loan payments will not be reported on credit reports until the end of 2024.

The primary data source for the report is the New York Fed’s Consumer Credit Panel, which is derived from anonymized Equifax credit report data. Because credit reports do not provide information on income, the authors use borrowers’ neighborhood income by merging information on their location with income data from the 2016 Census Bureau American Community Survey.

The report is the third installment in a series examining low-income households’ finances and access to credit. Two earlier reports, both called “The State of Low-Income America: Credit Access & Debt Payment,” were published in November 2020 and March 2022.

Contact

Connor Munsch

(347) 224-1175

Connor.Munsch@ny.frb.org

New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers – New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers – New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers

New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers – Delinquency – Credit Union Collections – Credit Union Collectors – Equifax

Facebook Comments