Black Book Market Insights – 5/30/2023

Wholesale Prices, Week Ending May 27th

The market continued to decline last week, with the Truck segments reporting an acceleration in the rate of depreciation and the largest single week decline since late January of this year. The Full-Size Van segment reported the largest decline for the segment since 2019, but the values remain elevated with many still surpassing original MSRP.

- On a volume-weighted basis, the overall Car segment decreased -0.11%. For reference, the previous week, cars decreased by -0.15%.

- Three of the nine Car segments increased last week.

- After eighteen weeks of increases, for an average weekly gain of +0.58%, the Sporty Car segment declined -0.19% last week.

- Prestige Luxury Car reported the largest decline for cars last week, down -0.33%, consistent with the previous three weeks that have averaged -0.33% decline each week.

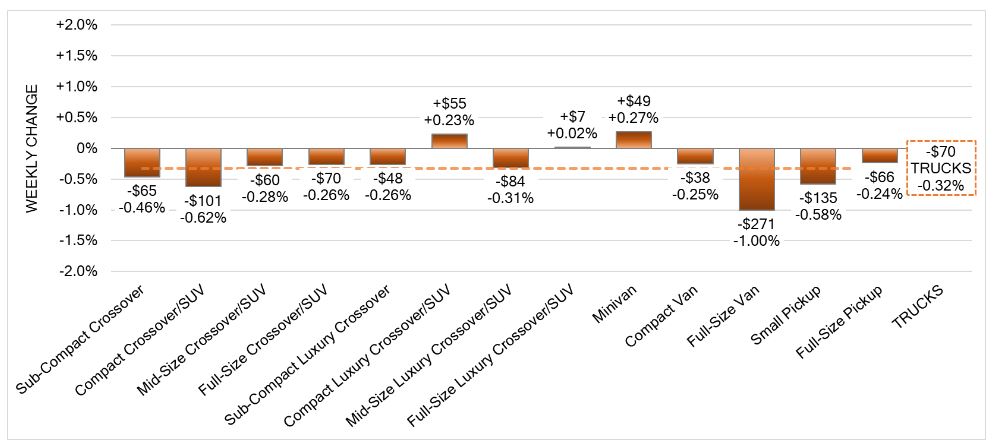

Truck / SUV Segments

- The volume-weighted, overall Truck segment decreased -0.32%, compared with the prior week’s decrease of -0.16%.

- Three of the thirteen Truck segments reported increases last week.

- A popular summer travel segment, Minivans (+0.27%) continue to report gains for fifteen consecutive weeks now with an average weekly increase of +0.60%.

- Full-Size Van had the largest decline last week, -1.00%. This is the largest decline for the segment since 2019.

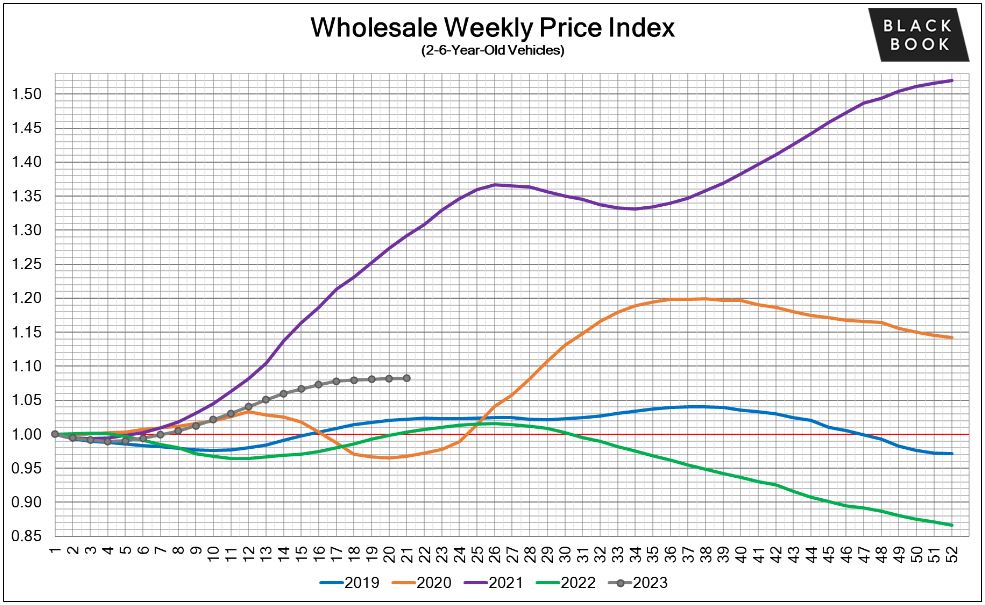

Weekly Wholesale Index

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last three years. We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for most of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December 2021, reporting over 1.51 points. In 2022, the price index was on a mild rollercoaster until July, after which point, prices were on a continuous decline until the end of the year.

Wholesale

For the second week in row, auction conversion rates were stable. With a holiday mixed in and people now starting their summer vacation, we saw little change in sales rates over the past weeks. 2500-3500 series truck prices continue to drop slightly more this week, while the 1500 series units are seeing relative stability. The Car segments saw movement downward, but as much as the truck segments.

As always, the Black Book team will continue to monitor and report on developing trends.

The Estimated Average Weekly Sales Rate remained at 48% last week.

Download the Entire Report Here!

Wholesale Auction Values Slide Continues – Black Book – Wholesale – Credit Union Collections – Credit Union Collectors

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Chinese National Caught in International Auto Loan Fraud Ring