“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” New York Fed

New York, NY – February 6, 2024 – On Tuesday, The Federal Reserve Bank of New York’s Center for Microeconomic Data issued its Quarterly Report on Household Debt and Credit. The report shows that not only did total household debt increase by $212 billion in the fourth quarter of 2023, but auto and credit card delinquencies are on the rise, but Gen X and Millennials are leading the way.

The NY Fed’s report created by their Consumer Credit Panel is compiled from data from credit reporting furnisher Equifax and breaks down all areas of credit and lending into the categories of mortgages, home equity loans, student loans, credit cards and auto loans. They then isolate the data by groups ranging from age groups to FICO bands in their study.

Holding steady in delinquency are the $1.6T in student loans, mostly due to forbearances, governmental dismissals and delinquencies not being reported until Q3 2024. Mortgages and HELOC’s are beginning to creep up to pre-pandemic levels but the areas where economic stress are starting to show the biggest problems are in credit cards and auto loans.

Credit Cards

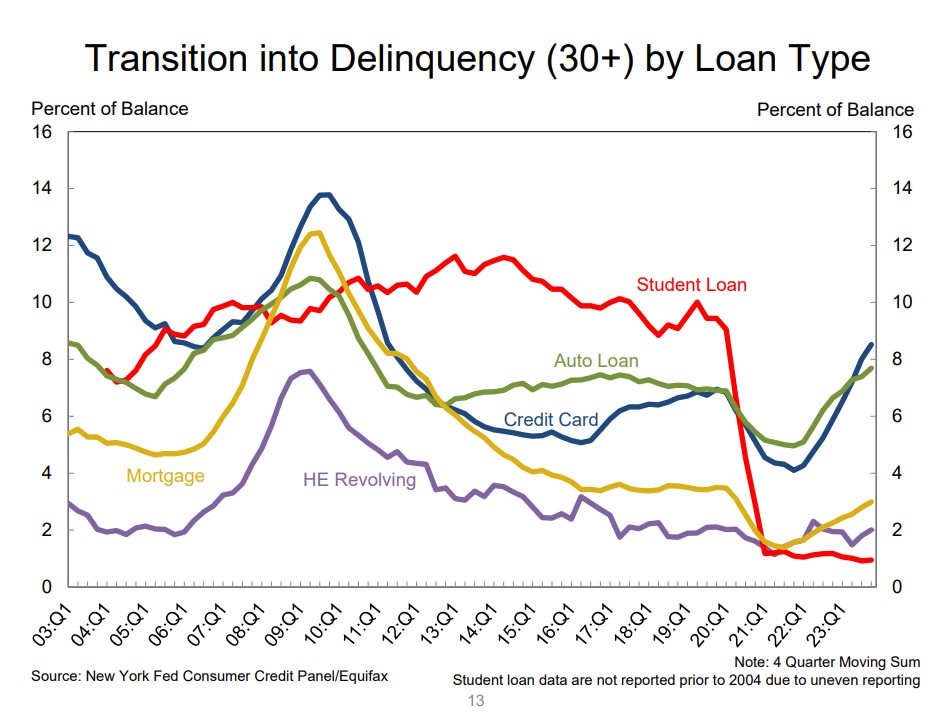

Credit card balances increased at year end by $50B (4.6%) to another record balance level of $1.13T. But following this record number is a 30-day delinquency ratio of 8.52%, a level not seen since the backside of the Great Recession in 2011.

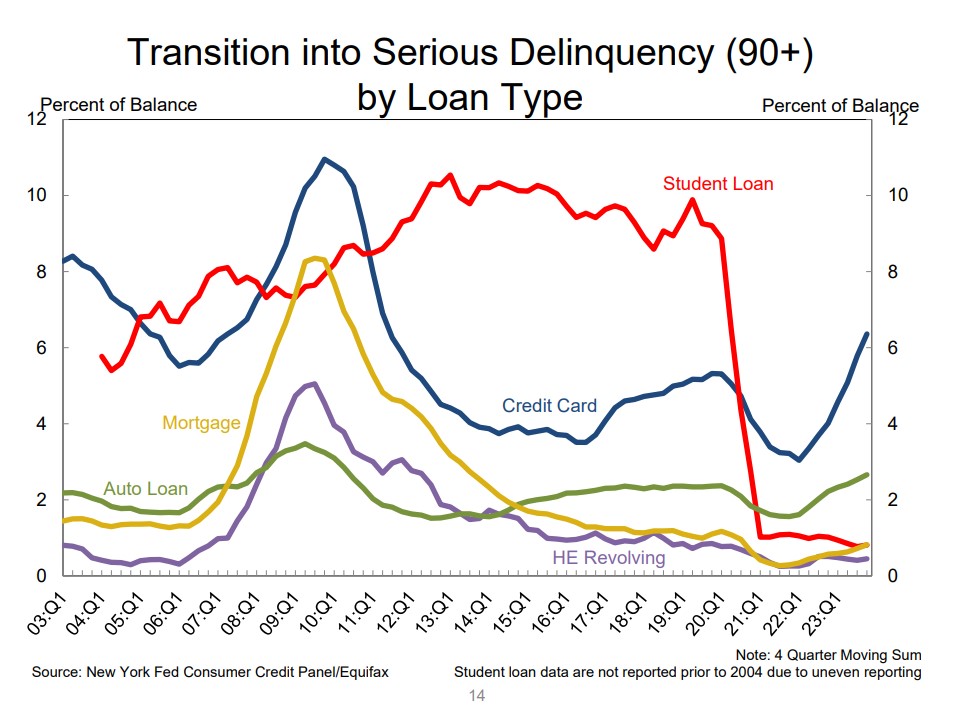

Omitted from the report is 60 days plus delinquency (reportable) but the 90-day delinquency levels were 6.36%, a number not seen since the Q2 201130-day delinquency levels.

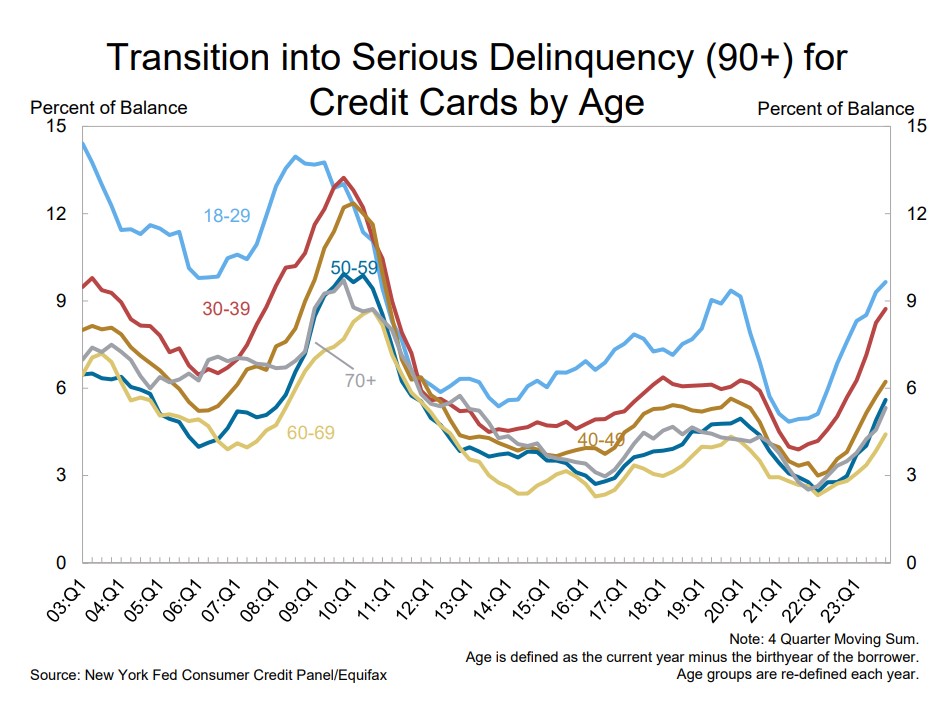

Drilling down deeper in to the age groups, it is clear that 18-29 year olds are having a rough time. Their Transition into Serious Delinquency (90+) ratios are at 9.65%, the highest levels since 2010. Ages 30-39 aren’t doing much better and are right behind them at 8.73%.

Auto Loans

Auto loan balances increased at year end by $12B to another record balance level of $1.61T. Their 30-day delinquency ratio rose to 7.69, the highest since Q4 of 2010.

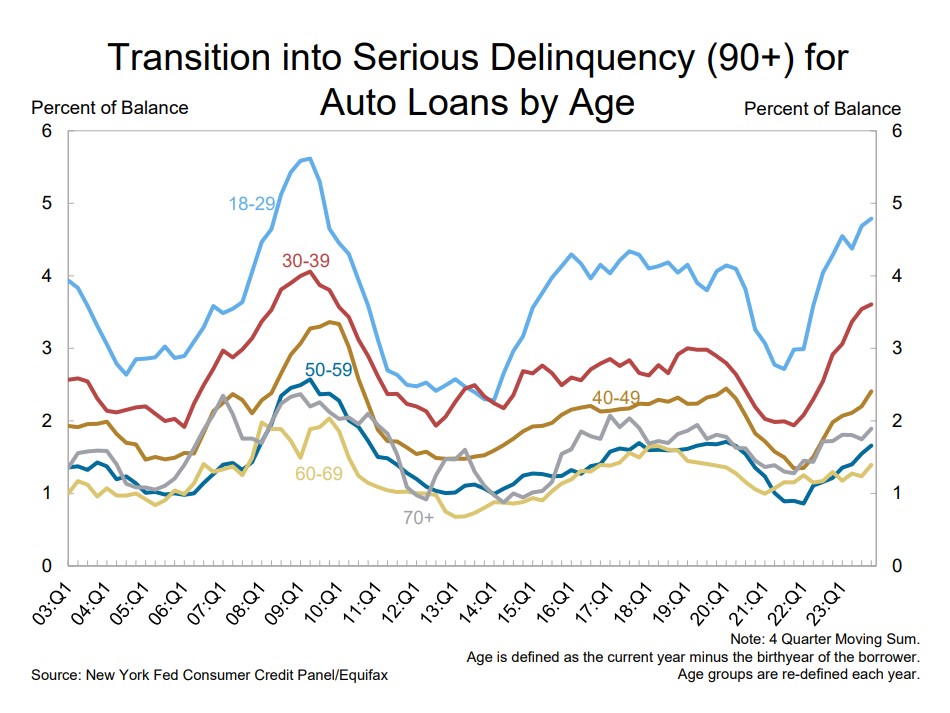

Their transition into serious delinquency level, (90+) ratios are 2.66%. The last time they were that high was the 2nd quarter of 2010.

For those borrowers between the ages of 18-29, their transition into serious delinquency level, (90+) ratios ended the year at 4.79%. They haven’t had it that bad since 3rd quarter of 2009. For the 30-39 age group, they were faring better but still poorly at 3.61%. You would have to go back to 4th quarter of 2009 to find their serious delinquency levels so high.

The Beginning or the End?

So, this begs the question where we are in this. Are we at the beginning of something more long term and more serious? That’s a hard question since traditionally, the end of 4th quarters tend to be the highest in the year, but if you look back at the beginning of the Great Recession, those numbers continued to climb for the next three years. Time will tell, but I’m pretty sure this is just the beginning.

This report holds a ton of interesting data points and trends and I strongly suggest that you take a browse through it. It really helps keep things in historical perspective. The data is also exportable to Excel if you wish to play with the data.

Kevin

Auto and Credit Card Delinquency the Highest in Over Ten Years – Auto and Credit Card Delinquency the Highest in Over Ten Years – Auto and Credit Card Delinquency the Highest in Over Ten Years

Auto and Credit Card Delinquency the Highest in Over Ten Years – Credit Union Collections – Credit Union Collectors – Delinquency – Equifax – Lending

Facebook Comments