Inflation is clearly taking its toll on the American consumer. Groceries, rent, credit card bills and record car payments are driving down savings while credit card balances climb. Couple that with a study that shows 12% of consumers spent more than they earned in the six months preceding October and it should come as little surprise that auto loan delinquency rates amongst two of the nation’s biggest auto lenders is soaring.

Over the past year, the percentage of consumers with car payments over $1,000 a month climbed from 10.5% to 15%. With the median American worker bringing home an estimated $54,132 a year in 2022, it’s not hard to see how paying such a large portion of their monthly income could be more than many can sustain. This strain is showing itself very clearly in the 1st quarter 2023 earnings and auto loan delinquency data from three of the banking worlds biggest lenders.

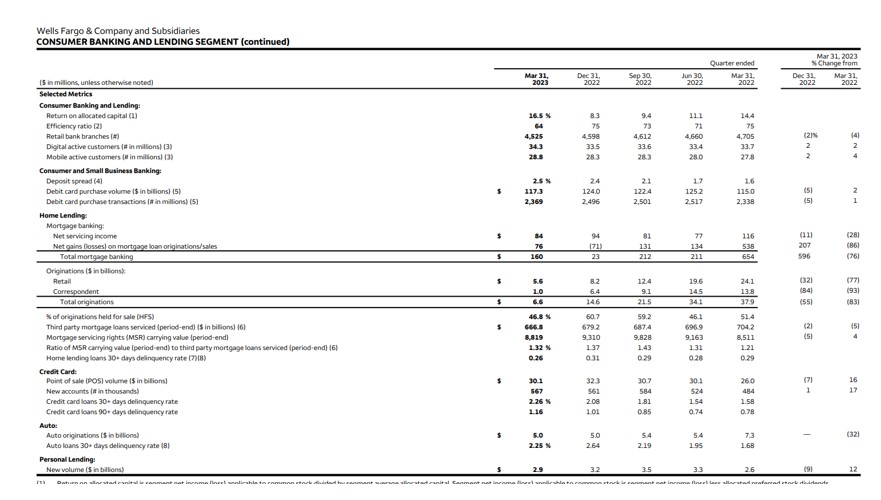

Wells Fargo’s company earnings announcement in the middle of last month showed earnings from their auto loan portfolio down in the March quarter and measured year over year, to down to $392 million. Their quarterly supplement also showed their auto loan originations had reduced 32% year over year to $5 billion. Wells Fargo’s auto loan delinquency rate rose for 30 days past due and greater to 2.3%. This is up from 1.7%. While only two basis points, their net loan charge-offs climbed to 0.9%, up from 0.7% from the prior year.

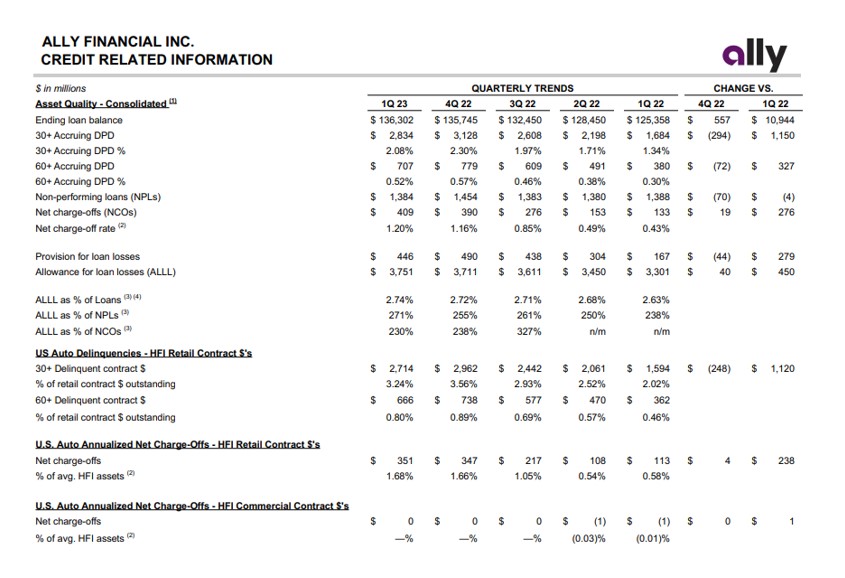

Ally Financial’s auto loan delinquencies showed a more dramatic increase and soared to 3.2%. That is a 2% increase over March 2022. Their net charge-off ratio on auto loans was a reported 1.7%, almost triple their March 2022 rate of 0.6%.

The total 30+ day delinquency rate on the auto loan book, as per the Ally data, show a March quarter of 3.2%, a jump over 2% last year. The net charge-off rate on the loans was a recent 1.7%, soaring above the 2022 March quarter rate of 0.6%.

While subprime originations have been on the decline, Fitch Ratings shows that the percentage of subprime auto borrowers at least 60 days late on their bills was 5.3%, more than double what they were in May of 2021, which was a seven-year low.

While these are some pretty dramatic increases, they are coming off of historical lows. But with higher car payments and higher interest rates adding to the dumpster fire of inflation, it is difficult to see how this trend won’t worsen. All the while, no one is talking about the pending resumption of student loan payments expected to hit this summer and what impact they may have.

Q1 Auto Delinquency Numbers Soar – Delinquency – Credit Union Collections – Credit Union Collectors

Facebook Comments