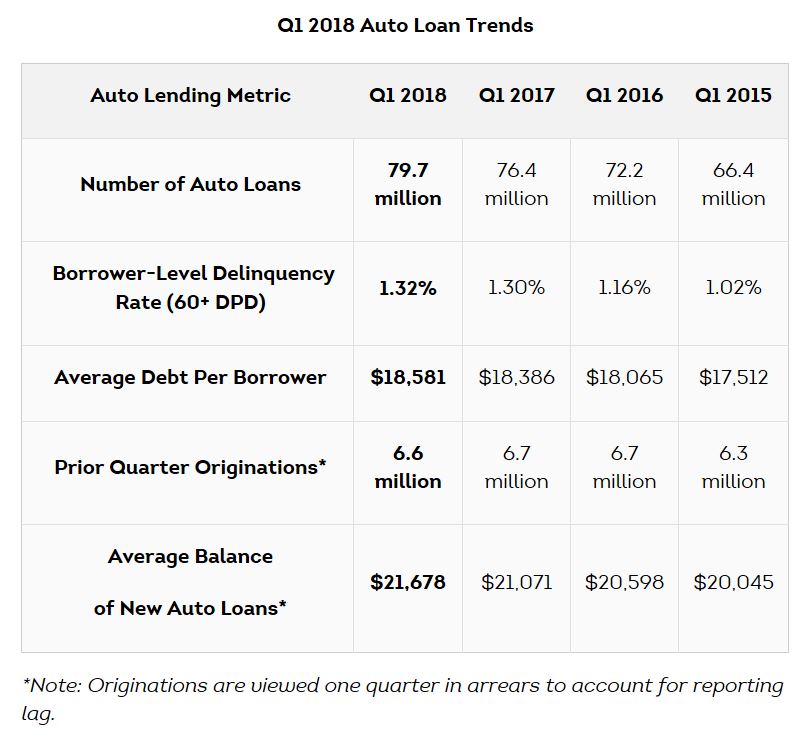

TransUnion’s Industry Insights Report found that tighter underwriting and improvements in the oil states appear to be positively impacting serious auto loan delinquency rates per borrower (60+ DPD). After growing from 1.16% in Q1 2016 to 1.30% in Q1 2017, the serious delinquency rate stayed relatively flat at 1.32% in Q1 2018. The top six states with the largest annual decreases in delinquency rates in Q1 2018 – Alaska, Wyoming, Texas, New Mexico, Oklahoma and North Dakota – are among the eight states where oil, gas, and mining account for 10% or more of gross domestic product.

TransUnion’s Industry Insights Report found that tighter underwriting and improvements in the oil states appear to be positively impacting serious auto loan delinquency rates per borrower (60+ DPD). After growing from 1.16% in Q1 2016 to 1.30% in Q1 2017, the serious delinquency rate stayed relatively flat at 1.32% in Q1 2018. The top six states with the largest annual decreases in delinquency rates in Q1 2018 – Alaska, Wyoming, Texas, New Mexico, Oklahoma and North Dakota – are among the eight states where oil, gas, and mining account for 10% or more of gross domestic product.

Facebook Comments